MODERN MPS

SOLUTIONS

We offer a complete range of multi-asset portfolio solutions

Click the options below to learn more about each portfolio:

- Defensive

- Conservative

- Balanced

- Adventurous

- Aggressive

Also available built with:

- Conservative

- Balanced

- Adventurous

- Defensive

- Balanced

- Conservative

- Balanced

- Adventurous

BESPOKE PORTFOLIO SERVICE

Our teams work closely with advisers to create bespoke investment

portfolios and ranges designed to reflect their specific requirements.

Risk Profile

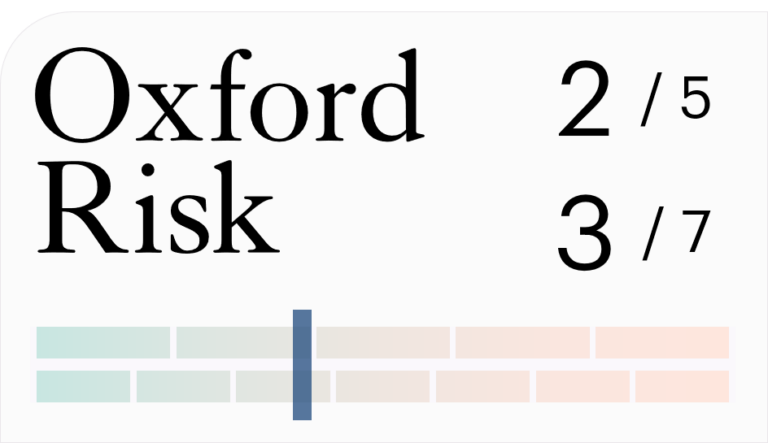

Defensive

Conservative

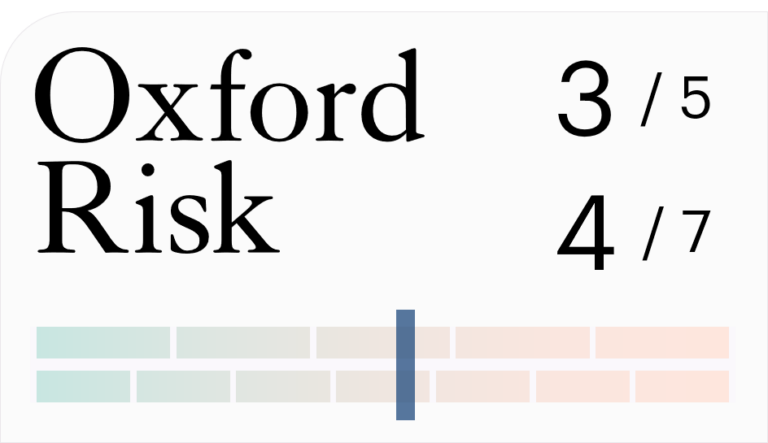

Balanced

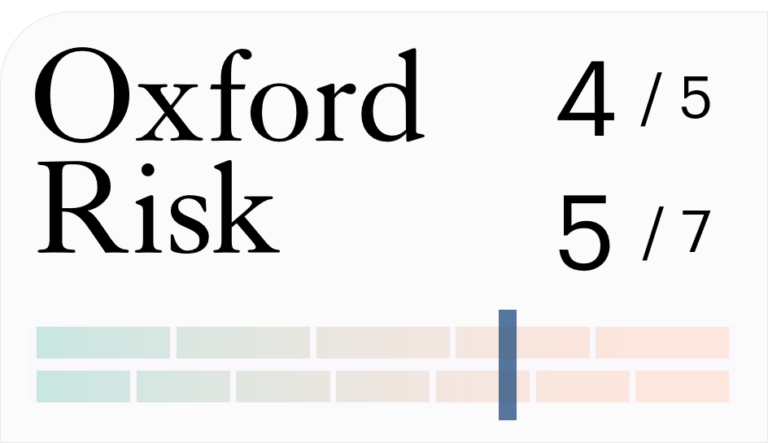

Adventurous

Aggressive

Institutional investment expertise

Core Growth

The Pacific Core Growth Range consists of five highly diversified multi-asset class portfolios designed to meet a range of client investment objectives. The range is fully diversified across: Asset Class, Geography, Currency, whilst utilising the benefits of active and passive investment styles. The portfolios carefully blend a mix of five broad asset classes: Equities, Fixed income, Alternatives, Diversifying Assets and Cash

Investment objective

The Defensive Growth Portfolio prioritises capital preservation, with a bias towards lower risk investments.

Suitability

Designed for investors who seek investment growth over not less than 5 years and who are prepared to accept some short-term potential for capital losses to generate potentially higher returns.

Benchmarks | Return objective

ARC Cautious | CPI +1%

Investment objective

The Conservative Growth Portfolio aims to achieve capital growth with a focus on capital preservation, combining lower risk investments and equity market exposure.

Suitability

Designed for investors who seek investment growth over not less than 5 years and who are prepared to accept the prospect of some short-term capital losses to achieve a high return.

Benchmarks | Return objective

ARC Composite (Conservative & Balanced) | CPI +2%

Investment objective

The Balanced Growth Portfolio aims to achieve capital growth with a balance of capital protection and equity market exposure.

Suitability

Designed for investors who seek investment growth over not less than 5 years and who are prepared to accept some short-term capital loses to achieve a higher return.

Benchmarks | Return objective

ARC Balanced | CPI +3%

Investment objective

The Adventurous Growth Portfolio aims to achieve capital growth, with a bias towards equity market exposure.

Suitability

Designed for investors who seek investment growth over not less than 5 years and who are prepared to accept the possibility of larger short-term capital losses to achieve strong market returns.

Benchmarks | Return objective

ARC Steady Growth | CPI +4%

Investment objective

The Aggressive Portfolio aims to maximise capital growth, with a significant bias towards equity market exposure.

Suitability

Designed for investors who seek investment growth over a term of 5-10 years and who are prepared to place the majority of their capital at risk to achieve strong market returns.

Benchmarks | Return objective

ARC Equity Risk | CPI +5%

Sustainable

The Pacific MPS Sustainable range consists of three risked targeted multi-asset portfolios designed for those investors who seek to grow the value of their capital but wish to ensure that strict environmental, social, governance (ESG) principles are applied to the underlying choice of the investments.

Investment objective

The Sustainable Conservative Portfolio aims to achieve capital growth using sustainable investments, with a focus on capital preservation, combining lower risk investments and equity market exposure.

Suitability

Designed for investors who seek capital growth over not less than 5 years through investment in a diversified range of ethically screened assets and are prepared to accept the prospect of some short-term capital losses to achieve a high return.

Benchmarks | Return objective

ARC Composite (Cautious & Balanced) | CPI +2%

Investment objective

The Sustainable Balanced Growth Portfolio aims to achieve capital growth using sustainable investments, balancing capital preservation and equity market exposure.

Suitability

Designed for investors who seek capital growth over not less than 5 years through investment in a diversified range of ethically screened assets and are prepared to accept the prospect of some short-term

capital losses to achieve a high return.

Benchmarks | Return objective

ARC Balanced | CPI +3%

Investment objective

The Sustainable Adventurous Portfolio aims to achieve capital growth using sustainable investments, with a bias towards equity market exposure.

Suitability

Designed for investors who seek capital growth over not less than 5 years through investment in a diversified range of ethically screened assets and are prepared to accept the prospect of some short-term capital losses to achieve a high return.

Benchmarks | Return objective

ARC Steady Growth | CPI +4%

Income

The primary investment objective for many people is to generate an income. The Pacific Income Portfolio Range is designed to generate a consistent source of growing income for each risk profile, while seeking to grow the value of the capital invested in line with the rate of UK inflation.

Investment objective

The Defensive Income Portfolio aims to provide a regular income whilst preserving capital, with a bias towards lower risk investments.

Suitability

Designed for investors who seek a regular investment income together with prospects for limited capital growth over not less than 5 years, and to achieve this are prepared to accept some short term potential for capital losses.

Benchmarks | Return objective

ARC Cautious | CPI +1%

Investment objective

The Balanced Income Portfolio aims to provide a regular income and capital growth, balancing capital preservation and equity market exposure.

Suitability

Designed for investors who seek a regular investment income together with capital growth over not less than 5 years and who are prepared to accept periodic capital losses to achieve a high total return.

Benchmarks | Return objective

ARC Balanced | CPI +3%

Passive

The Pacific Passive Portfolios provide multi-asset, cost-effective globally diversified investments through low-cost passive investments to meet a range of client investment objectives.

Investment objective

The Passive Conservative Growth Portfolio aims to achieve capital growth with a focus on capital preservation, by combining lower risk investments and equity market exposure, using low-cost passive investments.

Suitability

Designed for investors who seek a lower-cost means of achieving investment growth over not less than 5 years and who are prepared to accept the prospect of some short-term capital losses to achieve a high return.

Benchmarks | Return objective

ARC Composite (Conservative & Balanced) | CPI +2%

Investment objective

The Passive Balanced Growth Portfolio aims to achieve capital growth, balancing capital preservation and equity market exposure, using low-cost passive investments.

Suitability

Designed for investors who seek a regular investment income together with capital growth over not less than 5 years and who are prepared to accept larger short-term capital losses to achieve a high total return.

Benchmarks | Return objective

ARC Balanced | CPI +3%

Investment objective

The Passive Adventurous Growth Portfolio aims to achieve capital growth, with a bias towards equity market exposure, using low-cost passive investments.

Suitability

Designed for investors who seek a lower-cost means of achieving investment growth over not less than 5 years and who are prepared to accept the prospect of some short-term capital losses to achieve a high return.

Benchmarks | Return objective

ARC Steady Growth | CPI +4%