It’s hard to believe a year has passed since the launch of the Pacific Longevity & Social Change fund.

Information or opinions constrained in this article do not constitute and offer to sell or a solicitation, or offer to buy, any securities or financial instruments or investment advice or any advice or recommendation in respect if such securities or other financial instruments.

Back in late October 2021, few could have predicted the tumult that lay ahead. Markets have undergone 12 months of unprecedented volatility across all asset classes including Commodities, Currencies, Equities and Rates. Traditional correlations broke down, currency levels reached historic extremes, intraday moves in yields set new records and Central Banks intervened to support bouts of stress in the financial systems of developed economies including the UK, Italy and Japan.

At the start of November 2021 we celebrated the arrival of our new Fund, only for Omicron to cast a shadow over the world’s emergence from the pandemic. Fortunately, Omicron appeared to be more benign than earlier variants albeit supply chain bottlenecks remained a feature of life, exacerbated by COVID lockdowns in China. Sadly, events turned sour again in February with war breaking out between Russia and Ukraine. Sanctions placed on Russia contributed to volatility and an acceleration in the price of a range of commodities, not least gas, driving higher costs of a wide range of goods and services including transport and agricultural products.

If at the end of 2021 there was still a debate as to whether inflation was persistent or transitory, the months that followed dispelled any doubt, with inflation here to stay. Inflation reached new highs in September 2022 both in Europe and the US, having already lapped tough y-o-y comparisons in the months prior. Today, labour markets remain tight, commodity prices elevated (in historic context) and the geopolitical backdrop uncertain with the Russia/Ukraine conflict unresolved and China/US tensions at an all-time high. Recent bear market rallies reflected hopes for a slower pace of tightening by the Fed or an eventual pivot, while sell-offs followed a dose of reality from Central Banks’ messaging and strong macro data points which reinforced its stance.

The Pig in the Python – The Case for Longevity & Social Change

Equity investors want long term sustainable growth, however the return of equity market volatility driven by political, economic and market uncertainty, underscores the need to look beyond shorter-term market conditions and focus on the long-term drivers of both individuals and corporates in light of irrevocably rising life expectancies.

The Pig in the Python – is a metaphor often used to describe the Baby Boomer generation bulge moving through the cultural and economic cycles of the past 75+ years. From the beginning of the Baby Boom in 1946 right through the beginning of Boomers’ retirement, they have changed every phase of life they have passed through. Whether it be the toy industry in the 1950s following the surge in post-war births, higher education in the 1970s and 1980s, real estate boom in the 1980s and 1990s or the stock market rise from the mid 70s, the baby boomer bulge has impacted every sector of the economy. We believe the next major sectors to benefit from the Baby Boomers will be the healthcare, consumer health and financial planning sectors.

The over 65 population is expected to grow 5x faster than the broader population over the coming decade and account for over 50% of consumption growth in developed markets (McKinsey Global Institute –Urban World: the Global Consumers to Watch, April 2016). In the US, 10,000 people turn 65 every day and with the increasing prevalence of chronic disease, it is observed that people over the age of 65 experience three times more hospital days than the general public and twice as likely to visit a physician office. This is not just a Western market phenomenon, in the next 10 years China is set to add the equivalent of the entire population of Germany (84 mn people) to its cohort of people aged over 65. The Pacific Longevity and Social Change Fund seeks to capitalise on these shifting demographics by identifying companies who are set to benefit from this secular long-term growth opportunity.

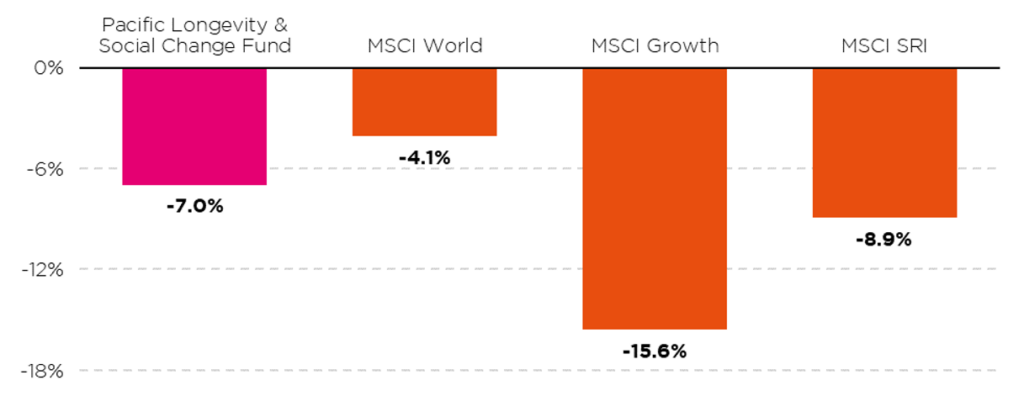

2022 YTD Performance in GBP - Outperforming Growth and SRI

Source: Bloomberg, Pacific Asset Management as of 31/12/21 – 14/11/22.

Past Performance is not indicative of future performance.

2022 has been a challenging year for performance but by focusing on high quality growth stocks and maintaining a broadly diversified portfolio across sectors and holdings, we have been able to outperform the MSCI Growth Index (-7.0% versus -15.6%) as well as the MSCI SRI Index (-8.9% in GBP). The Fund has not kept pace with its reference benchmark (the MSCI World index -4.1% year-to-date) however, with part of the underperformance is driven by our strategy excluding Energy and Commodities from its investable universe – partly on ESG consideration grounds and partly due to a lack of a clear link to the Longevity theme.

In 2022, the Energy sector has outperformed materially, delivering a 70% return, which means that this simple exclusion set our relative performance back by around 2%. While commodity prices may remain elevated, supporting Oil and Gas profits, the sector may also face increased pressure to make investments to increase capacity or become subject to windfall taxes.

Financials also dragged down fund performance over the last year, despite the “value” tilt of most of our holdings across Capital Markets and Insurance. Capital Markets sensitivity to market valuations is not new but what has been particularly striking over the last year is the unusual correlation between the movement in different asset classes which put pressure even on the relatively diversified asset managers such as Amundi and Blackrock. Whilst a prolonged recession could result in further earnings downgrades, valuations of many Financials stocks already reflect very pessimistic scenarios.

In an environment of rising living costs, our overweight exposure to the consumer discretionary sector could have weighed on performance. Thankfully the Fund’s exposure to the Education, Travel & Leisure and Fitness and Nutrition sub-themes contributed positively with the most notable relative contributors from Adtalem, Strategic Education, LuluLemon and Service Corp. We expect to see continued resilience in goods and services benefitting from pent up demand post two years of a pandemic environment as well as goods with strong functional and innovation features including leisurewear, footwear and beauty. While Staples delivered positive returns year to date, the relative underperformance of our portfolio holdings is mostly attributable to our exclusion of Alcohol and Tobacco as the consumption of such products is antithetical to healthspans and life expectancy.

Elevating the Social Pillar within ESG

We believe companies with strong ESG profiles do better over time and therefore analyse a company’s ESG practices alongside conventional financial metrics, excluding those operating in harmful sectors or conflicting with our principles of extending healthspans and life expectancy. Since inception of the fund, we have focused on elevating the “S” (social) dimension of ESG, particularly given the profound societal impact of demographic shifts. For example, women typically outlive men by approximately 5 years however by the time a woman reaches retirement age, their pension pots are typically 30-40% less than a man. With the broader market focus on the “E” (environmental) pillar within the ESG framework it is perhaps notable that the MSCI SRI Benchmark has underperformed the MSCI World index in the year to date period by 4.8% in GBP. Sector allocation of the MSCI SRI index is overweight Consumer Discretionary, Financials and Healthcare and underweight the Energy sector – much like the Longevity & Social Change portfolio. However, we posit that the Longevity fund’s focus on the Social pillar helped contribute to its outperformance versus the MSCI SRI index.

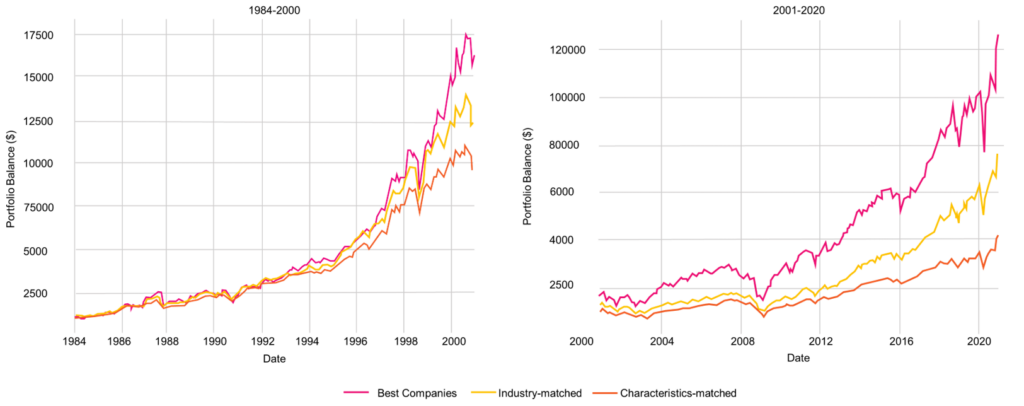

We firmly believe that integrating social factors into our investment portfolio can help drive more sustainable long-term returns. Indeed, an academic paper published in late 2021 reported that companies that treat their employees the best, earn an excess return of 2%-2.7% per year. The authors of the report similarly hypothesise that the persistent outperformance of “Best Companies” over four decades from 1984 to 2020 could be due to traditional SRI funds being more focused on the Environment and Governance dimensions of social responsibility rather than on the Social aspect.

EXHIBIT: Performance of $1000 initial investment in Best Companies’ equal-weighted portfolio along with the performance of two benchmarks: Characteristics-matched (based on size, value and momentum) and industry-matched portfolios.

Source: Financial Analysts Journal, 78:3, 129-151, June 16, 2022

The pandemic underscored a company’s most important resource is its employees. Companies with high employee satisfaction that limit the social impact of their operations should benefit over the long-term. In the current climate of high inflation and rising cost of living, it is essential to evaluate the overall contribution of a company to the societies in which it operates.

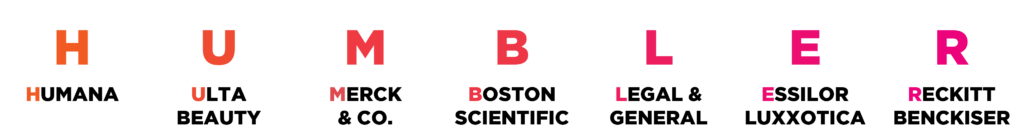

Time for something HUMBLER.

The past decade has been dominated by Big Tech with investment opportunities spanning electric cars, social media and the cloud. However, coming out of the pandemic, Healthcare, in all of its manifestations (biotech, diagnostics, genomics, pharma, medtech) has proven its worth and in our view is the sector that will lead the economy in the next 10-20 years, prolonging healthspans, extending lifespans and driving more efficient delivery of healthcare services. Tech will still play a critical role in society as an enabler of healthcare, whether it be via using AI for drug discovery or NLP to analyse medical records to identify at risk patients earlier. However, we believe Healthcare and Consumer Health will become a more desirable investment versus Tech and other growth sectors over the near to medium term. In turn, an extended wealth accumulation phase from longer working careers will drive increased demand for financial planning and insurance services – notably savings, wealth transfer and annuity products.

H.U.M.B.L.E.R. represents a small cross-section of Healthcare, Consumer Health and Financial Planning companies that offer attractive growth and some level of protection from the harsh macroeconomic outlook. Business variability among this selection of companies should prove more stable compared to other sectors within the market. Large-cap Pharma and Managed Care have been the two most consistent Healthcare sub-groups in 2022 and we expect this performance to persist going forwards. In turn, we believe this will feed into other areas within healthcare such as Medical Devices and Diagnostics, who are likely to be viewed more favorably, as the likes of Tech/Retail/Industrials fend off recessionary pressures. Aside from the tailwinds benefitting Financials from longer accumulation and decumulation horizons, we also view it as an attractively valued sector underpinned by attractive yields and strong capital positions.

While the pandemic has weighed heavily on many businesses over the past few years, the outlook for the Longevity and Social Change universe remains robust. Across the globe, populations continue to age and this creates opportunities for companies that provide products and services which cater to changing consumption patterns driven by shifts in demography. However, a diversified approach to portfolio construction is also required in a stagflationary environment. Business models will be stressed, brand strength challenged, the innovation capabilities and relevance of companies’ offerings will be tested. With the cost of capital climbing and real incomes shrinking due to inflation we believe those companies that can hold up well in a recessionary environment should prove to be good investments long-term.

Despite all the economic and geopolitical uncertainty, the growth outlook for the Longevity and Social Change universe is resilient. As the baby boomer generation advances into their retirement years, new needs and demands are emerging. For companies that meet those needs and demands, the returns should be substantial.