- It was important to remain diversified, tactical and build inflation resilience into portfolios in 2022, and we think the story will be similar for 2023.

- However, the asset classes and tools that we use to achieve these three aims might shift, as market volatility has thrown up opportunities after the tumult of 2022.

- Opportunities exist in inflation linked bonds, value stocks and non-US equity markets, as well as within alternatives and diversifying assets.

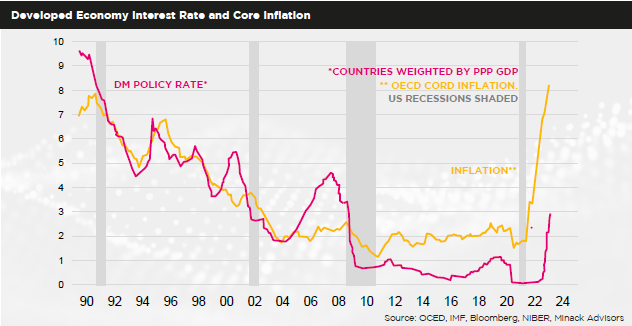

2022 will go down as one of the most challenging years investors have faced. Accelerating and broadening inflationary pressures forced central banks to act rapidly and in near unison, despite the causes of this inflation being different in different geographies. Initially, supply constraints pushed up goods inflation in many developed markets, but this soon broadened out into price pressures for services and into wage growth across developed markets, particularly the US. For Europe and the UK, the Russian invasion of Ukraine caused immense pressure on Energy markets, creating supply side inflation as the price of electricity production moved sharply higher.

There are three key three pillars to our process that were important in navigating 2022, but also that we believe will be critical for investing in 2023:

- Diversification

- Tactical Asset Allocation

- Building inflation resilience into portfolios

Diversification

Its role in 2022

Diversification was critical in 2022, when both equity and fixed income markets fell in tandem. Over the year, PAM’s allocations to Alternatives and Diversifying Assets provided useful diversification benefits.

We consider Alternative assets to be commodities, gold as well as infrastructure and listed commercial property. Many of these asset classes, including electricity generating infrastructure performed well and were an important source of diversification for portfolios in 2022.

Diversifying assets exposure comprises macro strategies, risk premia, and other strategies that are uncorrelated to equities and bonds. Strategies that utilised momentum were positive, as they capitalised on heightened macroeconomic volatility. A strategy that takes advantage of the dislocation between value equities and growth equities performed strongly over the year, up nearly 25%.

Diversification in 2023

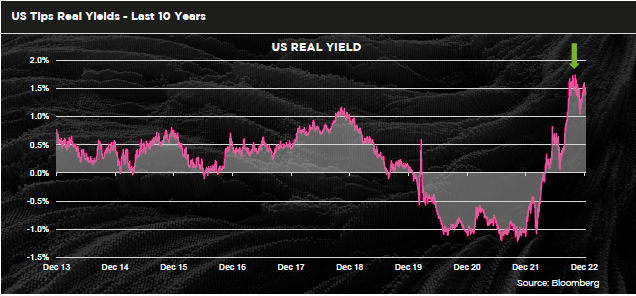

Last year, bonds and equities were falling simultaneously leaving no place to hide for portfolios lacking exposure to alternatives and diversifying assets. In fact, this was the worst year for a 60/40 portfolio of equities and bonds since 1937. This year however, we think that the positive correlation between equities and fixed income may recede, paving the way for more tools to diversify if growth does slow. We have therefore added an allocation to inflation linked bonds, whilst remaining cautious on economically sensitive fixed income such as High Yield.

We still believe our allocations in both diversifying assets and alternatives have scope to perform strongly in 2023, as markets continue to be volatile, with opportunities for us to add uncorrelated return drivers to portfolios outside of conventional assets.

Tactical Asset Allocation

Its role in 2022

2022 was a year for tactical asset allocation: although markets fell over the year, there were a number of sharp bounces in equity markets, including the current rally that has continued into the new year. It was a year where it was important to be active in our equity positioning. Much of the selloff in equities over the year was driven by financial tightening conditions, a result of developed market central bank policies, but as with many bear markets there were a series of sharp rallies as markets reassessed the likelihood for a growth slowdown and digested central bank speak. We were reactive to these rallies short term, adding to risk assets, but with the view that the medium-term trend for markets was lower.

In addition, although most markets fell, there were some regions that were more resilient, including large cap UK companies where we tilted our portfolios. These companies are global in nature (and were therefore less exposed to UK domestic growth concerns), and trade at a valuation discount to global peers. The UK index ended flat at the end of the year, a very strong result versus other markets.

Inflation in 2023

We think that the worst of the inflationary pressures have passed in the short term for the global economy, as growth and inflation measures have started to roll over in many developed economies. However, history shows us it can often take several years for inflation to normalise following shocks such as those seen post-COVID, and our view, given the valuation disparity in markets is that value strategies remain attractive. Given this, and the concentration of indices such as the US in growth focussed companies, we also believe that there is opportunities for active management to outperform in 2023, after years of lacklustre returns.

Conclusion

We think that in 2023, many of the key themes that investors needed to focus on in 2022 will continue, but with a slightly different flavour. Diversification will remain crucial, but the asset classes that provide the best diversification may well change, as market pricing has moved a lot over the past year.

The Federal Reserve continues to keep monetary policy tight, the unemployment rate needs to rise in the US to stave-off inflationary pressures and to normalise wage pressures, but the headline unemployment rate has never risen by 0.5% without triggering a recession. It is possible that the Federal Reserve will pull off this trick, but history is against them. The economic cycle in the post-COVID world has been rapidly changing, and therefore remaining tactical and adaptable will be vital to success in markets. Finally, we expect that although headline inflation will cool this year, longer-term inflation is likely to be higher this decade than in the previous two. It is therefore important to have a portfolio that can weather a more volatile inflation backdrop.