- Economic growth has been resilient, and inflation has continued to normalise, but remains above central banks’ target levels. Expectations for interest rate cuts have been pushed back towards the end of the year.

- Stronger growth has benefited equities, and the largest companies in the world are seeing some of the fastest earnings growth.

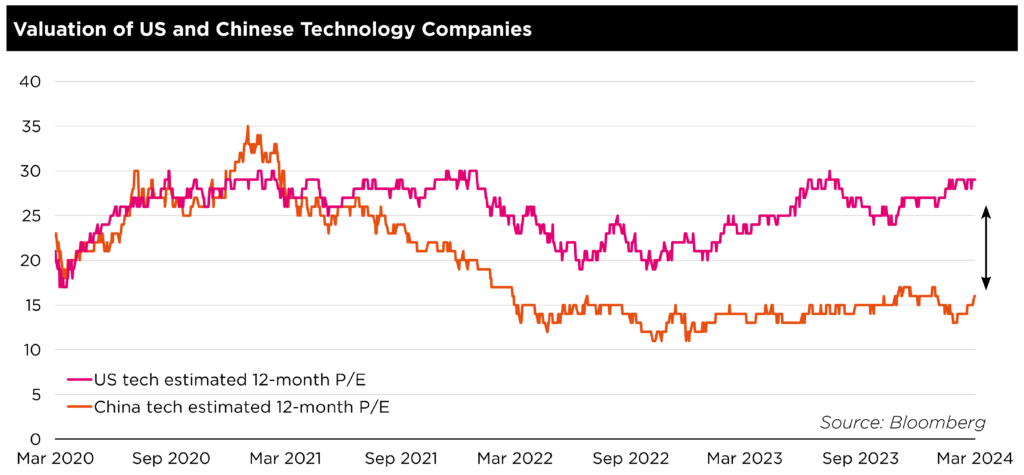

- Chinese equities, on the other hand have suffered because of a regulatory crackdown. We think there is an opportunity for a rerating as the earnings outlook improves.

Outlook

Resilient growth and stickier inflation have pushed back expectations for US interest rates cuts to late Autumn, in line with the views of the Federal Reserve. If Chair Jerome Powell can navigate a path to soft landing, market and economic historians will celebrate this rare feat.

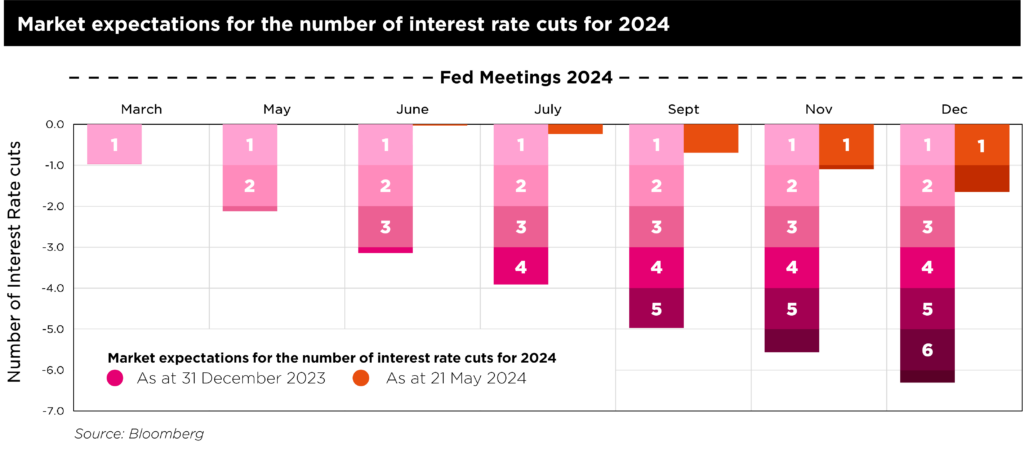

At the start of the year, the market was expecting centralbanks in the US and the UK to have started cutting interest rates in March. Resilient growth and stickier inflation put paid to that idea. It now seems likely that the Bank of England will start cutting interest rates in the summer, ahead of the Federal Reserve who will need longer to see inflation cool sufficiently to start to pare back interest rates. Expectations in the market for interest rates at the start of the year were for six cuts in 2024, now the market expects two at most, starting in September or November:

Global growth has continued to surprise even the most

bullish forecasts as US consumers have benefited from a strong labour market

and wage growth. Their spending continues to be boosted by the savings that

they built up during the pandemic, as well as income on their savings from

higher interest rates. In the US in particular, much of the debt of consumers

is longer dated, and has been set at lower interest rates that prevailed in the

previous decade. However, lower income households that rely on shorter term

debt are starting to struggle having mostly used up their excess savings.

Soft Landing?

If the Fed manages to pull off a soft landing, their failure

to anticipate the post COVID spike in inflation will be forgiven. If this

happens, Jerome Powell will be remembered as the Chair of the Fed who navigated

the economy through this inflation shock and brought inflation back to earth

without triggering a recession. Alan Greenspan pulled off a similar trick some

30 years ago and was (briefly) named “Maestro” as a result.

There are clearly risks to this scenario: monetary policy is

understood to work with long and variable lags and so higher interest rates may

finally weigh on growth and trigger a hard landing. Alternatively, inflation may

remain stubbornly high or worse, re-accelerate, requiring more interest rate

hikes from the Fed. But for now, the growth/inflation mix is supportive for

corporate earnings and therefore equity markets.

This improving economic backdrop has led to strong equity

markets in the developed world over the last six months, led by US stocks and

the remarkable Magnificent Seven. The world has seen giant companies before,

and it’s not unusual to find fast growing companies. But both giant and fast

growing is extraordinary: these companies have a larger market capitalization than

France, Germany and the UK combined, and grew their earnings by 43% in 2023.

For now, they are regarded as the winners from AI and it’s likely that

investors will overestimate the effect of AI in the short term and

underestimate its impact over the long term. Whether many of the Seven maintain

their place at the top for the coming decade remains to be seen, but for now,

their earnings power has pushed them to the forefront of investors’ minds.

Opportunities in China

If Mag 7 and the US has been the big winner over the last 6

months, are there opportunities for catch up elsewhere in the world? One equity

market where there has been absolutely no sign of exuberance is China. At the

end of 2020, the technology stocks in China were flying high, growing rapidly,

and loved by emerging markets growth managers around the world. And then

President Xi cut them down to size, with a raft of regulatory crackdown

measures designed to bring these companies into line. Their fall from grace was

swift and painful with the Hang Seng Technology index losing three quarters of

their value in under two years.

In January we saw classic signs of capitulation: hedge fund

liquidations, extreme negative sentiment and positioning, talk of China being

uninvestible; real signs of “blood in the streets”. And yet, these companies’

earnings are starting to re-accelerate and their valuations are trading at half

that of their US peers:

We believe this represents an opportunity for a tactical investment in Chinese technology companies, where investors are now underexposed. These companies are involved in e-commerce, electrification and AI and trade at attractive valuations. Further, the tone of regulators appears to have softened, and the central bank and fiscal policy are becoming more supportive in China.

CONCLUSION

The three potential end games mean that it’s important to

have portfolios that are genuinely diversified and able to respond to an

evolving economy and market. For now, a soft landing looks the most likely

outcome, despite the rarity of such events. In this case, equity markets would

continue to thrive. The combination of surprisingly resilient economic growth

and sticky inflation suggests that there are risks that central banks, and the

Fed in particular, haven’t done enough to slay the inflation dragon, requiring

rates to remain higher for longer. The US Equity market has been the big winner

in terms of recent performance, and the earnings power of the Magnificent 7 has

been remarkable, but if global growth picks up performance will likely broaden

out to other markets.