Focus on “alpha” generation in liquid, high-grade credit

The Fund is managed by leading global active credit fund manager, Coolabah Capital Investments (Coolabah).

The Coolabah investment team combines a proprietary quantitative asset-selection approach with deep fundamental research aiming to deliver superior risk-adjusted returns whilst maintaining a consistently high-quality credit portfolio.

Stewardship is central to the fund manager’s approach, emphasising a commitment to effect real change. A dedicated six-person credit research team has joint responsibility for proprietary ESG research and portfolio integration.

ABOUT COOLABAH CAPITAL INVESTMENTS (CCI)

DISTINCTIVE OFFERING

- USD 5 billion* AUM across a longstanding

diversified client base of institutional and retail investors - Active credit traders – executed ~USD60bn of global credit trades since 1 Jan 2021

HIGHLY EXPERIENCED TEAM

- Seasoned team with decades of experience in fixed-income management, trading, quantitative and credit research capabilities

- Focus on generating alpha in liquid, high-grade credit without taking interest rate risk

ACTIVIST APPROACH

- CCI is signatory of the UN-supported

Principles for Responsible Investment - Dedicated six-person research team with joint responsibility for proprietary ESG research and portfolio integration

*Source: Coolabah Capital Investments as at June 2023.

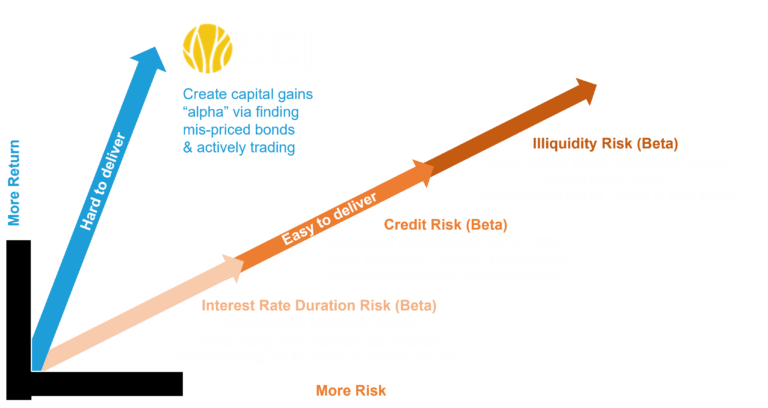

THE EXISTENTIAL CHOICE:

ADD-VALUE OR ADD RISK?

CCI focuses on trading high-quality bonds to reduce idiosyncratic risks

GLOBAL FIXED INCOME MARKET IS HIGHLY INEFFICIENT

Providing compelling active trading opportunities

Cash bonds are highly inefficient

Most investment-grade fixed income is traded OTC and by “voice”

- No transparent central exchange or mandated price disclosure

- Leads to highly opaque/inefficient asset pricing

Limited use of quantitative models for real asset valuation analysis

- Assets more commonly priced off crude appraisal/qualitative judgement

- Explains under investment in credit and quantitative research

Inefficiency compounded by proliferation of “passive” styles

Most “active” fixed income managers are very passive, “buy-and-hold” investors

- Function of predominance of passive fees for active styles

- Prevalence of closet indexers

Investors typically overdiversified

- Diversification can be a vehicle for taking much more credit risk or beta

Regulatory reform since the 2008 crisis has changed credit markets

Regulation such as the Dodd-Frank Act. / Volcker Rule has forced banks to withdraw from proprietary trading

Regulation such as Basel III has reduced the ability of banks and market-makers to hold inventory on their own balance sheets

- Bank warehouses have virtually disappeared

Market-makers also constrained from holding certain types of debt securities

All these factors contribute to market inefficiencies that Coolabah Capital Investments look to exploit

Hear from the team

Pacific Active Credit Strategy Introduction

Hear from Chris Joye, CEO and Senior Portfolio Manager, Coolabah Capital Investments.

Chris introduces Coolabah, the team, their experience and the reasons for partnering with Pacific

Chris explains why the Global Fixed Income Market is highly inefficient and how it provides compelling active trading opportunities

Matt Linsey, managing partner & portfolio manager

Chris founded Coolabah in 2011, hear more about his background and experience

Listen to how the team combines a highly repeatable proprietary quantitative approach with deep fundamental research

Pacific Active Credit Strategy Market Update

Hear from Chris Joye, CEO and Senior Portfolio Manager and Fionn O’Leary, Head of European Trading, Coolabah Capital Investments.

Investment philosophy

Three major investment principles:

1

ALPHA FROM INEFFICIENCIES IN LIQUID HIGHGRADE BONDS

Identify mis-priced assets that offer the expectation of superior risk-adjusted returns. The liquid credit market trades bilaterally over the-counter (off exchange) leading to opaque asset pricing and opportunities. CCI utilise an intensively active style with a high trading turnover to monetise mis-pricings.

2

MINIMISE

IDIOSYNCRATIC

CREDIT RISK

Dedicated Research Team undertakes deep credit, commercial and regulatory analysis with low risk tolerance and veto rights. Avoid allocations to idiosyncratic fundamental risks and leverage allocations to high quality securities.

3

FOCUS ON QUANTITATIVE

& TECHNICAL DISLOCATIONS

Sophisticated, proprietary scalable, portable models, developed and productionised internally by our dedicated Data Science Team. Allows team to exploit mis-pricings in primary and secondary markets.

Enables CCI to serve as an opportunistic liquidity provider, generating alpha from execution.

find out more:

Pacific North

of South EM All Cap Equity

Contact us

Speak to a member of the client team to find out more:

Contact us

Speak to a member of the client team to find out more: