Single Manager Solutions:

North American Opportunities

Thinking differently in North America

The Pacific North American Opportunities Fund offers a distinctive investment opportunity defined by its unwavering emphasis on bottom-up analysis and stock-picking, deemphasising macroeconomic distractions. The fund manager takes an all-cap, benchmark agnostic, concentrated approach, within a capacity constrained fund.

Specialists in North American Equities

The investment team for the North American Opportunities Fund is led by Chris Fidyk, a highly-experienced professional who has over 15 years of investment experience in North American Equity markets and a proven track record of generating returns in various market environments.

The manager combines consistent generation of eclectic investment ideas and in-depth bottom-up analysis within a framework that maximises the potential for outperformance.

Guiding principles

The team follow three guiding principles, forming a foundation for the teams investment process

1

Avoid

losses

The Portfolio Manager seeks to understand and control the downside risk in each individual investment and carefully considers the amount of capital that can be lost if the investment performs poorly.

2

Keep

it Simple

This serves as a tool that helps the investment team to mitigate risks and accelerate decision-making in times of stress and also allows the investment team to sleep well at night (which improves decision-making).

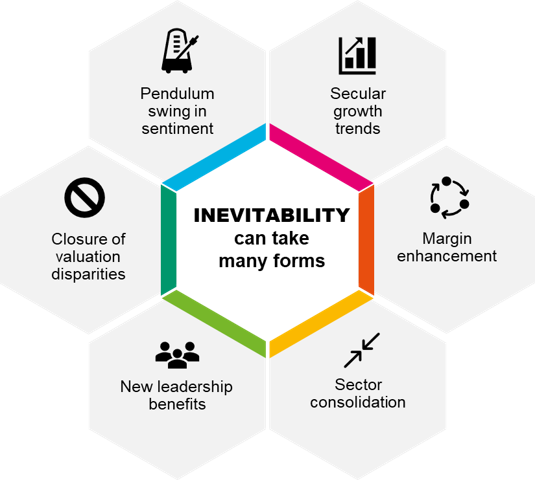

3

Seek

Inevitability

The investment process is focused on identifying investment prospects where future outcomes are inevitable. Equities are securities that discount the future, and the Portfolio Manager believes that investing in equities is made easier when future outcomes can be understood with some precision.

SEEKING INEVITABLE OUTCOMES

The investment team search everywhere possible for interesting investment ideas with the goal to identify companies where future outcomes are inevitable.

Why seek inevitability?

- Risk mitigation (including ESG)

- Filtering mechanism

- Maintain long-term focus

- Simplify decision-making

- Provides valuation context

- Stabiliser in times of dislocation

the 'non-negotiables'

We will ask three questions when assessing new ideas

Do we have a competitive advantage?

Is the management elite?

Can we earn 15% IRR?

Why Invest?

Highly experienced Portfolio Manager with a long track record of generating outstanding returns in North American equities

Fund structured to maximise alpha; concentrated, all cap, benchmark agnostic, and capacity constrained

Three guiding principles that form a foundation for the investment process of the strategy: Avoid Losses; Keep it Simple; Seek Inevitability

Highly active, stock-picking focus with in depth bottom-up analysis that is not distracted by macro

Portfolio constructed of eclectic ideas that looks very different from the S&P 500

The team search everywhere possible for investment ideas with the goal to identify companies where future outcomes are inevitable

Portfolio team

CHRIS FIDYK

Portfolio Manager

Sam lewis

Research Analyst

DOCUMENTS

find out more:

Contact us

Speak to a member of the client team to find out more: