Second bite of the cherry?

Global FI Macro provided positive performance early this year, when long duration struggled. We argue, that again the opportunity exists to diversify away from long bond exposure. The vulnerability of having 12 months’ worth of carry and roll wiped out by a small increase in yields is back in investors’ minds.

UST 10y yields were recently at 1.12% and Bund 10y at -0.50%, back at February levels and well below their equivalent 10y inflation swap break evens of 2.60% and 1.65% respectively. You may ask yourself, “Well, how did I get here?” Which happens to be a memorable line from the Talking Heads song – Once in a Lifetime. Like any good lyric, it is applicable to many scenarios in life.

Put another way, what is so special about this? Well, globally, a lot has progressed economically and politically since February. We will go through those progressions and why the factors that have got us here present a ‘second bite of the cherry’. Let’s start by looking to answer the question within the lyric, by analysing the factors that have contributed to lower yields.

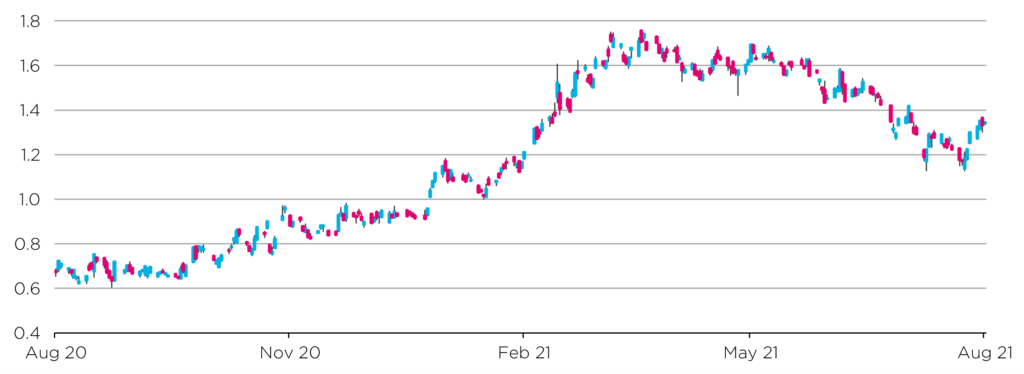

UST 10Y Yield

From August 2020 to August 2021

Source: Bloomberg

Short duration consensus – There was no secret that many market players and strategists were expecting UST10y yields to be closer to 2% at 2021-year end on the back of large fiscal and successful vaccine programs. Quite simply, many of those stale/offside short positions are being cleaned out.

Delta variant wave – In the US, states with lower vaccination rates are suffering the side effects of lack of immunity with the highly contagious variant. This is blocking local health care systems and slowing the rate of economic recovery, calling into question near term growth momentum. Elsewhere globally cases are flaring up in previously successful containment nations like China, Japan, Malaysia, Australia, and South Korea.

China regulatory clamp down – From video games to online tutoring, Xi Jinping is wrestling back control of online data under a range of guises, the latest being the happiness and physical and mental wellbeing of Chinas’ children. This clampdown is on regulatory arbitrage with the state viewing Chinese companies as having to maintain their Chinese standards in all jurisdictions. The consequence of the now interstellar reach of Chinese regulation had led to an understandable worry in tech stocks with Q3 GDP expectations recently being revised significantly lower.

Reduced bond supply – Summer suspension or reduction of bond issuance combined with a forecast reduction in Q4 issuance from the USA and European governments are at very advanced levels of their annual issuance, so less needed in Q4.

Continued QE buying – Central Bank bond purchases continue at record pace in the US and Europe, where the Federal Reserve and ECB continue to expand their balance sheets at an unprecedented rate. This buying reduces the net supply of issuance to the market.

Hawkish rhetoric from Central Banks – June FOMC meeting revealed more hawkish stance than expected by financial markets. Several members forecasted interest rate hikes in 2022. This resulted in interest rate markets pricing in the Fed pre-emptively tightening monetary policy, leading to lower terminal yields.

Looking at each of the above factors – many, if not all, can be discounted as ‘transitory’

History has repeatedly shown that after a wash-out, once the market is more neutral in its duration positioning, the more likelihood there is for rates to drift up to levels more consistent with high inflation numbers and less negative real rates.

The delta variant although contagious is not having the same impact as previous variants. As seen by the reopening of the economy in a largely vaccinated UK, where increased case levels are not being reflected in the same hospitalisation or fatality rates as previously experienced. Therefore, as the global economic powerhouses get their vaccination rates closer to 70% the ability to return to a more normal operating economy increases.

Post the sharp repricing lower in tech stocks, China has already hinted that it is done with regulatory clampdown for this year. Admittedly this doesn’t discount further intervention next year, however, there are many expecting a Q4 increase in fiscal spending to offset some of the damage done so far and the recent loan extensions provided to the troubled construction industry seem to back this up.

It may be self-explanatory, but it’s important to mention that when summer ends the bond supply will increase again. The Fed and BoE have become more hawkish at recent meetings and shortened their timeline and criteria to taper or QT. Each have implicitly expressed benchmarks required for action. Taper may not provoke the same tantrum as 2013 but should allow the central bank premium to be unwound (believed to be 50-75bp).

Conclusion

As the market’s time horizon extends, the temporary nature of the above factors that have driven yields lower should dissipate. As monetary policy gradually normalises with the reduction of QE, yields will look more out of sync with the economic reality around them. The successful passing of infrastructure programs in Europe and US should also aid economic momentum, along with the return to the global workforce of many furloughed and wage subsidised workers. Whether wage inflation is persistent or not will determine the extent that central banks need to contain inflation expectations to their respective mandates. This scenario reflects a repeat of some of the moves in Q1 2021. Like then, bonds may not be helpful for those portfolios hedging equity exposure with long duration. We would advocate mangers relook at Global FI Macro, which performed well earlier this year as a diversifier, mitigating the duration underperformance experienced elsewhere.