There is a nervousness in the investment community, that the negative performance of bonds and equities may continue. This time might actually be different. After all, we have enjoyed years of financial excess creating returns of untold wealth. That excess was underpinned by a three plus decade decline in yields and inflation, and increased levels of debt facilitated by access to cheaper credit for individuals, companies, and governments, all causing a boom in asset prices. Is it going to unwind?

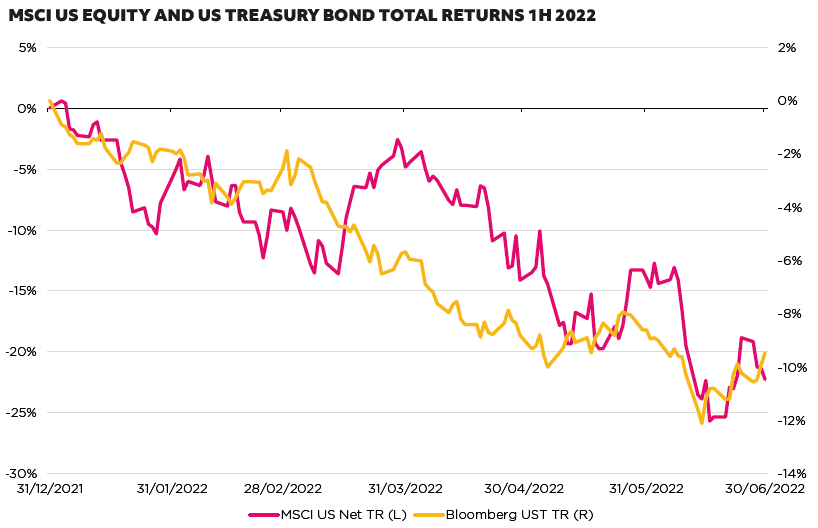

Bloomberg, June 2022

Previous downdrafts in economic cycles were slowed or supported by policy rates that bounced off progressive lows. The GFC of ‘08 then saw central banks move unconventional policies like negative interest rates and quantitative easing (QE) into the suite of ordinary policy responses. More recently, due to covid, fiscal support was added, as governments tried to provide all possible help to the economy grappling with the effects of once-in-acentury pandemic that had brought global economic activity to a stand-still. In the end, the combination of fiscal and monetary stimulus by far overshadowed the economic shock of the lockdowns. This policy response combined with supply-chain constraints resulted in a Macroeconomics 101 case of increased demand into tighter supply, generating multi-decade high inflation. Which was then compounded by the Russian invasion of Ukraine in February 2022.

While the strong economic rebound of 2021 with a subsequent slowdown into 2022 and 2023 was widely expected, darker clouds are gathering on the horizon. Central banks, caught behind the curve, are now catching up by withdrawing monetary stimulus at a rapid pace to try control inflation. Real incomes are getting squeezed, and supply-chain disruptions continue to rock production capacity. If global growth slows more aggressively, there is little in the way of latent demand to soften the blow, especially with China economically locked down, and the western consumer quickly losing discretionary spending power. Moreover, fiscal, and monetary authorities are unlikely to come to the rescue. Their focus has shifted to fighting inflation and it is a top priority that has become political, this will be extremely hard to achieve without inducing a recession.

‘Stagflation’ has made its way back to the lexicon of market commentators for the first time in four decades. As tighter monetary policy slows demand, central banks can’t avoid tipping their economies into a recession. Many are increasing interest rates of 0.5% increments or more, fearing second round effects, central banks speak for a wage-inflation spiral. Fed officials are currently forecasting the labour market to remain at post-GFC tight levels and inflation to drop by 4% back towards their target, trying to land softly on the edge of a razor blade.

So, with central banks unable to rescue risk assets, the traditional safety net is suspended. Do we finally realise past potential economic pain that has been regularly “kicked down the road” by “Fed puts” (easier policy)? The true benefit of capitalism is the re-allocation of capital to the most efficient uses. This process requires periodic economic downturns to weed out inefficient companies, however interference from progressively easier central bank policies, and/or political injection has failed it. The potential exists for the decades long backlog to catch up.

In summary, equity and bond holdings have both suffered significant drawdowns in 2022 and are vulnerable to further shocks as central banks are focused on inflation. The risks are; further bond weakness based on sticky inflation forcing rates higher for longer, and the reversal of G10 central banks’ balance sheet expansions, lowering liquidity and leading to credit spreads significantly widening further, and stocks continuing to fall as margins and multiples are eroded by lower demand.

In this uncertain environment we think the alternative to conventional bond hedges is Liquid Alternatives strategies in fixed income for any portfolio looking to achieve real diversification.