As featured in:

IPE D.A.CH: How would you describe our readers the investment strategy in a few sentences?

Marshall: The aim is to deliver the cash rate (ECB deposit rate) *approx. + 4% excess return, or alpha. We make all our returns using the familiar asset class of the G10 government bonds and interest rates. We use short term G10 government debt to generate the ECB rate and longer maturities to generate the alpha part.

IPE D.A.CH: You said, correlation to both equity as well as bonds is low. How do the numbers look like?

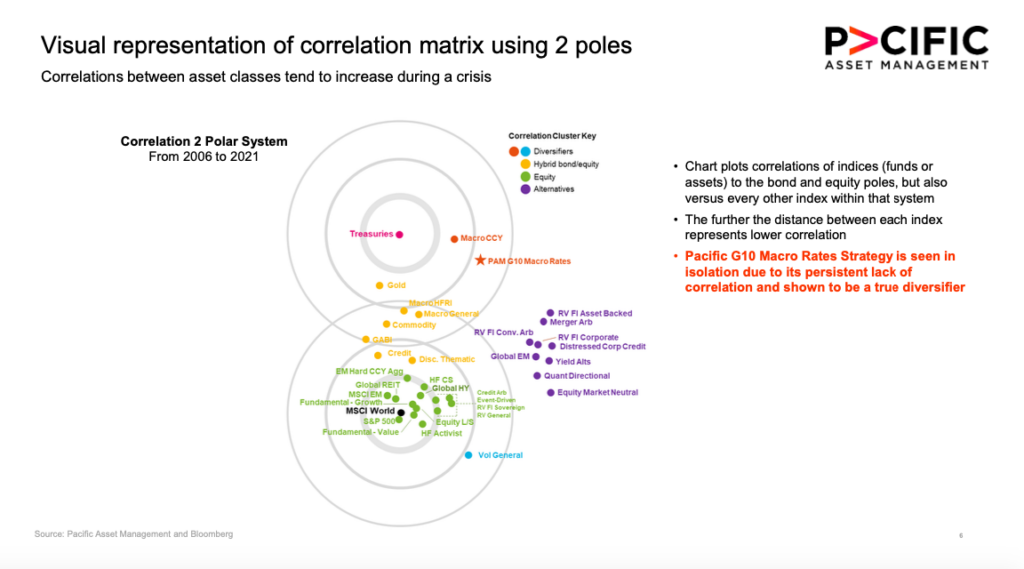

Marshall: The raw numbers – we have a correlation of 0.24 to US Treasury ETF and 0.34 to ACWI ETF. These ETFs are good proxies for total return indices in global bonds and global equities (I’m using monthly data over 4.5 years).

The low correlation numbers we maintain are crucial, as we believe they contribute significantly to client satisfaction. This satisfaction, we’ve found, stems largely from our ability to offer what our clients have explicitly sought: ‘true diversification.’ This is a challenging goal, but our approach appears to resonate well, especially since we also tend to show a low correlation compared to other Macro managers.

IPE D.A.CH: How is this achieved?

Marshall: Well, the first thing to say is that it is an outcome, not an objective. We generate our alpha by looking for, and monetizing, market dislocations. This investment process is very different to traditional high conviction “macro” funds; hence the returns arrive at different times to directional moves in the market. Additionally, the fund has no equities or credit, and that also helps keep the correlations low.

True diversification? I’ll explain… We have a correlation matrix where the assets are colored by type. We find that the assets form groups or clusters. This clustering means that choosing a second asset from the same cluster doesn’t give your portfolio a significant diversification benefit. Allocators know this already, which is why they look to construct portfolios that get the best diversification with the minimum number of asset choices. The advantage of our fund is that we are in a unique cluster that is both very different to others and has a very limited number of competitors. (see graphic)

IPE D.A.CH: Could you explain the investment process itself a little bit deeper?

Marshall: To generate the excess returns, or “alpha” part, we invest in a broad collection of temporary dislocations in the G10 government bond & interest rate markets. So, the fund makes its excess returns as these dislocations revert to their long-run average value.

Viewing these dislocations as opportunities is an integral part of an investment process typically characterized as a relative-value process. This approach was initially developed by myself and Shayne Dunlap, co-portfolio manager of the Pacific G10 Rates Fund, during our 15 years of working together on the proprietary trading desk of a Japanese Mega Bank.

The dislocations arise because even though government bond markets are very efficient, they are not 100% efficient. The sources of the dislocations are varied, it can be economic data, debt issuance, central bank decisions, fiscal policy, or simply large hedging flows that the market cannot absorb efficiently. However, the effect of these different forces is very similar – they all act to push the market away from its fair value and that gives us an opportunity.

So, it’s the relative-value approach to capturing the dislocations that is the key to understanding the strategy.

IPE D.A.CH: How important is implementation efficiency in that context?

Marshall: Efficiency is important because it helps us deliver better returns to our customers. It allows us to minimize transaction costs; it enables us to spot the dislocations / opportunities quicker; and it helps us construct trades that are durable and have good risk vs reward.

IPE D.A.CH: Can you give more insight to your thoughts on todays’ markets and what are the investment decisions you make out of it?

Marshall: My crystal ball is just as cloudy as the next person’s one! However, I can tell you where the economy is currently positioned and where there are good opportunities!

Economically – Listen to the ECB and other G10 central banks – they are communicating that we’re at, or close to the top of the cycle and I see no reason to disagree. The allocators we talk to know how to position portfolios for that environment and are at varying points of completion in that journey.

Opportunity – European bond curves are too flat and steepening trades are likely the best opportunity at this moment. However, it comes with a health warning – extracting the best from that opportunity is very tricky! This difficulty is particularly true in German Bunds, where the 2y bond is 1% below the ECB deposit rate, which gives a highly punitive cost of holding the trade. So, a simplistic approach to the steepening trade is unlikely to generate positive returns. Additionally, with the curve so inverted vanilla bond funds are unable to generate the positive roll down and carry that was enjoyed by participants in the “good old days”.

Putting these ideas together leads to my thought that, right now, accessing experience and / or using more technical active managers should provide a benefit to the customer.

IPE D.A.CH: Can you give one or two examples from the portfolio?

Marshall: Two examples – Austria to Australia, both very different types of dislocation / opportunity.

Austrian government bonds have a liquidity discount. Austria is a good credit vs other G10 governments, but it’s bonds currently don’t reflect that! The Austrians have been issuing debt more quickly than usual and now there is a dislocation that the economics cannot justify. So, you can buy the 10y Austrian bond cheaply and hedge the duration using a mix of France, Italy and Germany. This opportunity works slowly over time as the bonds revert to the fair price. However, it also has the potential to work much quicker if investors become cautious or worried about Italian government debt and the short side becomes the profit generator.

New-Zealand cost of capital is too low (relatively). NZ should, within reason, have a higher cost of capital than Australia, but in the 7y sector it doesn’t! So, right now, you can buy Australian yields at very slightly higher level than NZ. Amazing! This pricing currently exists due to the economy’s relative performance. However, historical analysis shows this is extremely unlikely to be realized, hence the opportunity. However, it gets even better than that… This relationship is very stable and moves within a historic range of roughly 1%, so when NZ yields are 1% over Australia you can put the opposite trade on and make money on the reverse move.

IPE D.A.CH: Is there a current focus on a specific trade type like Vola, FX or Curve?

Marshall: We are quite disciplined about the types of trade we implement, because using a wide variety enables us to construct a diversified portfolio.

We have seven types of trade in total and recently our most profitable have been Spread Trades (like the Austrian bond example) and the Cross-Currency trades (like the NZ vs Australia example). Typically, we have a larger exposure to curve trades, which reflects the experience we earnt whilst trading at a Japanese Mega-Bank’s very well managed proprietary trading desk.

IPE D.A.CH: How important is liquidity when taking investment decisions?

Marshall: G10 government bonds markets are the building blocks of the rest of the world’s liquidity. So, in most scenarios, liquidity is not a concern.

However, we take liquidity seriously and because we have always executed our own transactions, we have a direct view of the liquidity available throughout many different types of market. At times, for example during COVID, we have used this information to help us manage the fund and we think this gives us an advantage which is most relevant in times of market stress.

IPE D.A.CH: Will you be able to produce the same “alpha” to global fixed income markets with the base rates being higher?

Marshall: A higher rate from the ECB, means a higher cash rate returned to our investors. So, the cash part of our returns are straight forward to deliver.

For the “alpha” part, I mentioned the specific sources of our returns and the inefficiencies of markets when answering your 3rd question. These sources were suppressed, but not absent, during the financial repression of the 2010s. However, right now financial repression is dead and markets are now allowed to operate more freely. So, for the first time in a long while the market is now free to flip from pricing a recession to pricing a reflation. We can take advantage at these extremes of pricing and turn the dislocations into an opportunity.

With this new freedom of pricing and with the uncertainty of the future path of the economy, I think that the frequency of opportunities occurring is going to be both higher and more consistent.

And I think this dynamic is true for all active managers, irrespective of their asset class, and so active management is likely to enjoy a resurgence going forwards.

IPE D.A.CH: Can you explain your risk management

Marshall: We use targets and stops at inception to manage each individual trade’s upside and downside risk. However, there are times of market stress where this is not enough, and the fund has a higher volatility than is reasonable. During these times we act to manage the volatility lower by using macro trades to reduce the portfolio’s correlation to adverse market moves. To me it is important that we do this, so that by acting in the client’s best interests they benefit from the skill and experience we have and receive the best outcome that we can achieve.