Snapshot

- Equities hit Peak Concentration in 2023, But a Silver Tsunami is Rising: Healthcare could be poised for a Golden Age.

- There is significant value emerging in Healthcare, not seen since 1999, driven by improving fundamentals and leveraging AI to improve outcomes.

- Longevity & Social Change has gradually taken selected exposure to some innovative small and mid-sized companies which the team are extremely excited about.

Watermelon Sugar, all time high?

As we close the book on 2023, a year marked by dramatic swings and promising trends, it’s crucial to survey the landscape and navigate the path ahead. While the “Santa Rally” of Q4 offered a welcome surge, it’s vital to remember that underlying economic realities remain complex. Global equities rallied 15% in the last 2 months of 2023, the tenth highest two-month return for MSCI World since Woodstock (1969 Boomers!). With the Fed signalling at least 3 rates cuts at its December FOMC meeting, a soft-landing scenario for the global economy is now the central view. While it continues to play out, macro risks remain with a cooling consumer, prolonged monetary policy drag and geopolitical stress continuing to cast a shadow. Longevity, with its focus on long-term demographics and defensive positioning, is poised to navigate the currents of change and deliver unwavering value for investors.

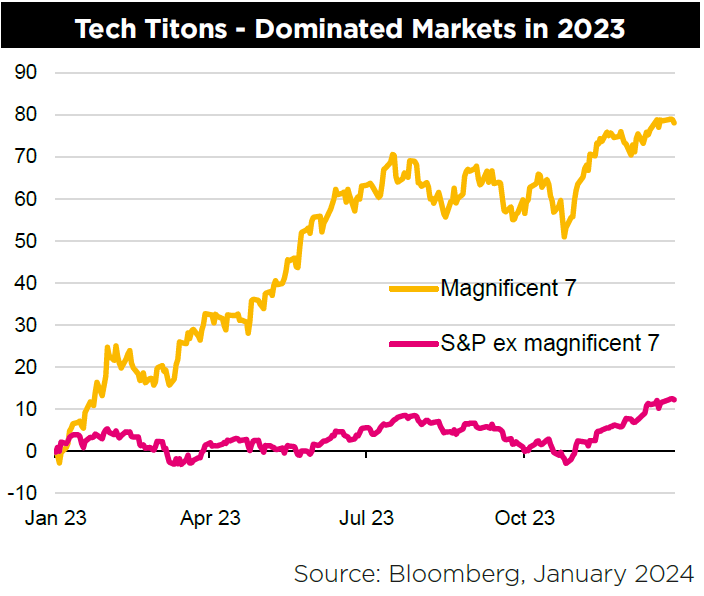

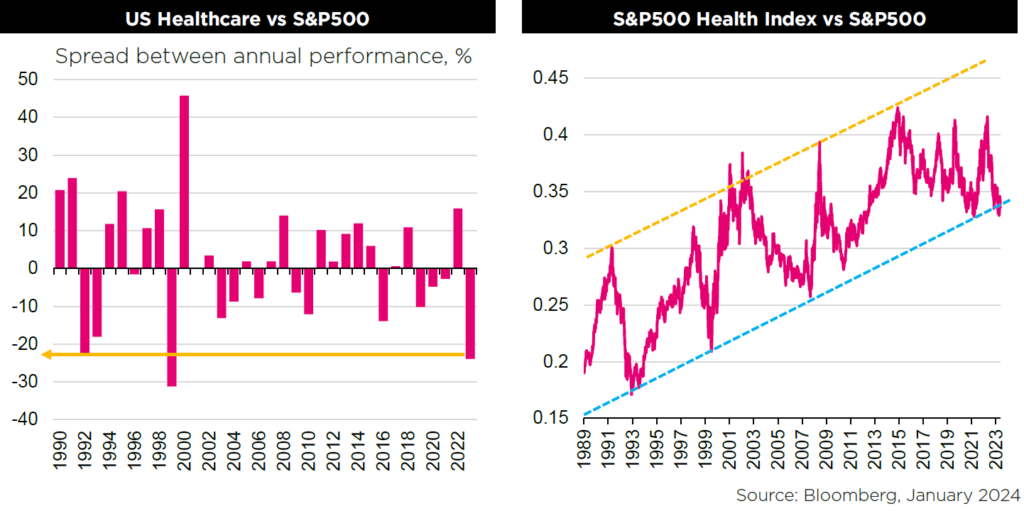

At the heart of this resilience lies the healthcare sector where the Longevity and Social Change fund has approximately 50% of its holdings. We see a positive macro backdrop for the industry in 2024. It is defensive, non-cyclical, has low leverage, strong cashflows and attractive valuations. While the US Tech Titans reigned supreme in 2023, with the likes of NVIDIA, Microsoft, Google, Tesla, Meta, Amazon and Apple accounting for over half of total market returns (see figure 1), US Healthcare saw its worst relative annual performance versus the S&P500 since 1999 (see figure 2) and leadership was incredibly narrow with Eli Lilly one of the few standout performers (+61%) driven by excitement around its obesity drugs.

In a world where the prices of many other types of assets or equity sectors appear rich, we see significant “value” in healthcare driven by improving fundamentals. We believe it’s unlikely that healthcare underperforms again in 2024, even with the turbulence of a US election year. While the normal political rhetoric around drug pricing and insurance is likely to find airtime among Republicans and Democrats, we expect healthcare policy to be overshadowed by key campaign issues like the economy, immigration and foreign policy. Moreover, existing sector valuations and prior 12-month relative performance likely already factor in some election-related volatility.

Healthcare: Reaping the benefits of Genomics and AI

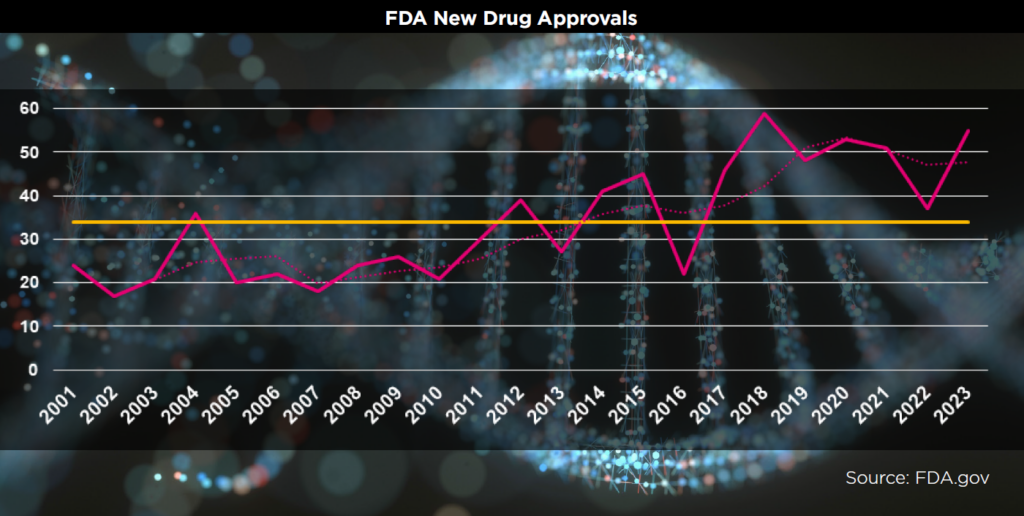

Drug development has undergone a remarkable transformation over the last two decades. Average annual approvals have skyrocketed from 23 in the 2001-2010 era to 49 and 47 in the past 5 and 10 years, respectively. This step-up is a testament to the power of genetics, genomics, and now, the rising tide of Artificial Intelligence. Healthcare companies are wielding AI to revolutionise patient outcomes and it’s not simply confined to drug discovery.

AI is being used to develop treatment planning software that can help doctors deliver more precise care. Within the Fund, Procept BioRobotics is a leading example where this is being leveraged. Procept’s AquaBeam Robotic system is an advanced, image-guided, surgical robotic system that combines real-time, multidimensional imaging with personalized treatment planning and automated robotics to precisely and rapidly remove prostate tissue. Procept claims that its robotic and waterjet technologies enable targeted and controlled tissue removal with rapid resection times that are highly consistent across all prostate sizes and shapes, and surgeon experience level.

AI is also being used to select the best therapies for patients with cancer (Guardant Health/Exact Sciences), monitor patients remotely for early warning signs of health problems (Philips, Tandem Diabetes Care) or detect more cancers from AI-based medical imaging (Hologic). With respect to Hologic, its ‘Genius AI Detection’ solution can see more detail in each mammogram than the human eye can, and checks each image against the standards to find any abnormalities. According to Hologic, this has resulted in a +9% improvement compared to radiologists not using Genius AI Detection solution in observed reader sensitivity for cancer cases. This equates to finding approximately one additional cancer for every 10 cancers correctly identified by a radiologist.

The furore surrounding AI was a significant factor in the strong performance of Tech during 2023, as investors flocked indiscriminately to companies perceived to be beneficiaries. Very few of the Longevity and Social Change fund holdings participated in this rally and yet we believe many are set to transform the healthcare industry through their deployment of AI. We remain highly attuned to identifying quality companies with proven operating models and strong innovation characteristics that not only have exposure to the durable and resilient growth offered by the Longevity and Social Change theme but also stand to benefit from the utilisation of AI.

Financials: Giving Credit Where it is Due

The last two years showcased how quickly Financials can fall out of favour on concerns over systemic risks in the financial system. Both the LDI crisis of 2022 and US regional banks turbulence in early 2023 were such stress tests. The fact that contagion across the wider financial system was avoided in both cases stands to underline that regulatory efforts around capital requirements since the GFC transformed the financials ecosystem to be better able to weather external shocks. While outcomes for Credit Suisse and SVB were less than optimal, both, we would argue, had idiosyncratic factors at play that led to their downfall. Now that yields seem to have stabilised, we expect Financials to have a solid year with fundamentals and earnings trajectory as the main drivers of performance. We expect modestly positive mark to market in FY2024 to support earnings for asset managers. Fixed income flows look set to get a boost from eventual rotation out of money market funds and deposits, particularly once rates start to fall. Alternatives are poised for a pickup in deal activity with valuations likely to see support from stabilising yields. Life insurers should also benefit from a strong PRT pipeline, improving investment yields, solid solvency, a stabilisation in the CRE market and still solid credit metrics with the caveat that this assumes a deep recession is averted.

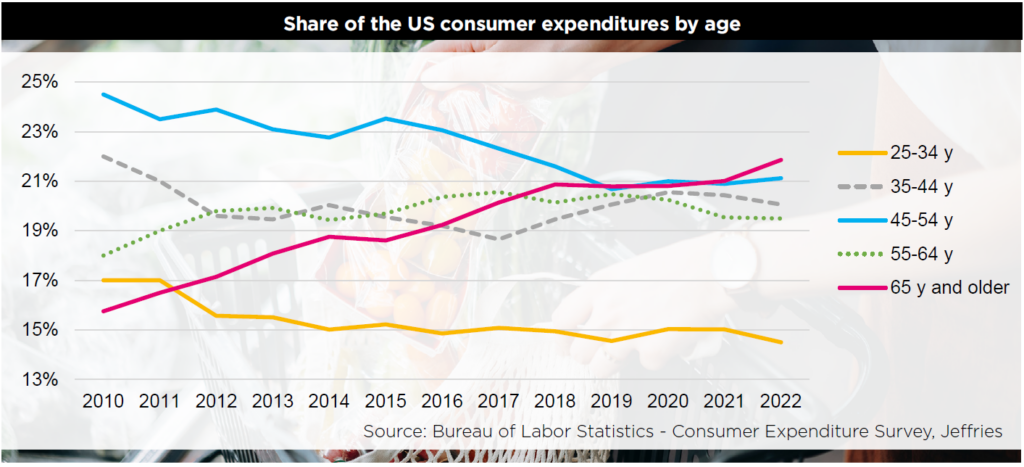

Consumer sector is likely to remain bifurcated

2023 concerns about potential spillover effects from the renewal of student debt repayments didn’t seem to materialise, but a number of discretionary categories remain under pressure from more discerning spending patterns and in some cases inflated inventories. These include parts of fitness apparel, luxury and parts of home improvement. Most of the Consumer discretionary exposure in our portfolio relates to potentially more resilient areas including Pet Care, Funeral Care, Personal Care and Education. A combination of secular trends from ageing demographics and inherent resilience of these categories position the group to perform well in a range of economic scenarios in 2024. The concentration of wealth in the older age cohorts also means that this demographic is likely to be a key beneficiary of the monetary tightening cycle as the income on their savings increases boosting spending power. In fact, data from the US Labour Department published in September 2023 shows Americans aged 65+ accounted for 22% of total consumer spending in 2022 – the highest share among consumer age groups and up from only 15% in 2010. Abating inflation and rising real incomes could offer upside support to the more discretionary categories such as Fitness Apparel and Travel & Leisure.

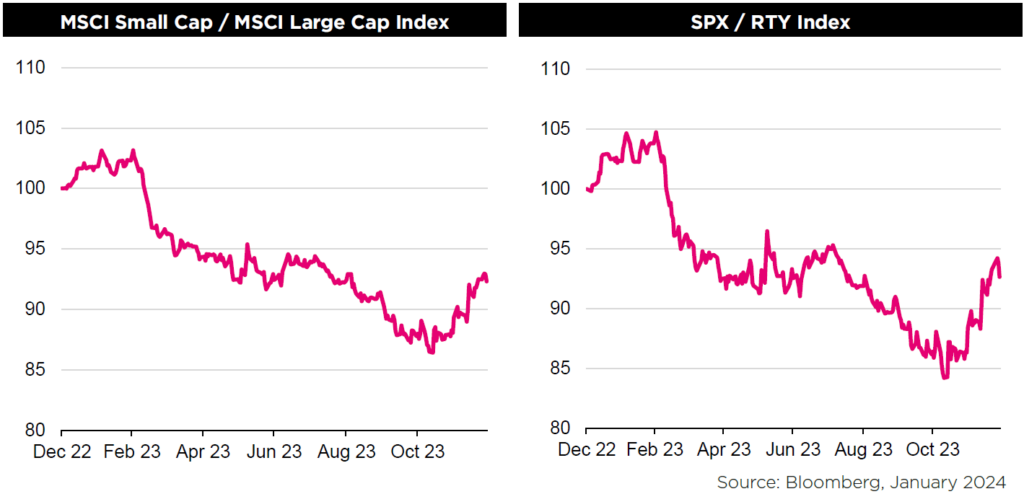

Concentration reigns, size matters

Market concentration reached a new peak for equities in 2023 with the seven biggest US stocks making up the same proportion of the global market as Japan, China, UK, France and Canada. At the end of 2023, the “Magnificent Seven” accounted for 16% of the MSCI World Index and had rallied 74%. This compared with the remaining 2,914 constituents which grew just 12%. “Size” also played a crucial role with investors shunning SMID-cap growth stocks and seeking refuge in mega-caps with the divergence in performance between large and small-call indices extremely wide. The Longevity and Social Change fund has eschewed the mega-caps in favour of seeking out attractively valued SMID and Large-cap companies with the potential for attractive and sustainable growth long-term. We remain committed to this approach and are optimistic that as interest rates come down, the performance of our SMID-cap holdings will improve greatly.

Portfolio positioning and performance

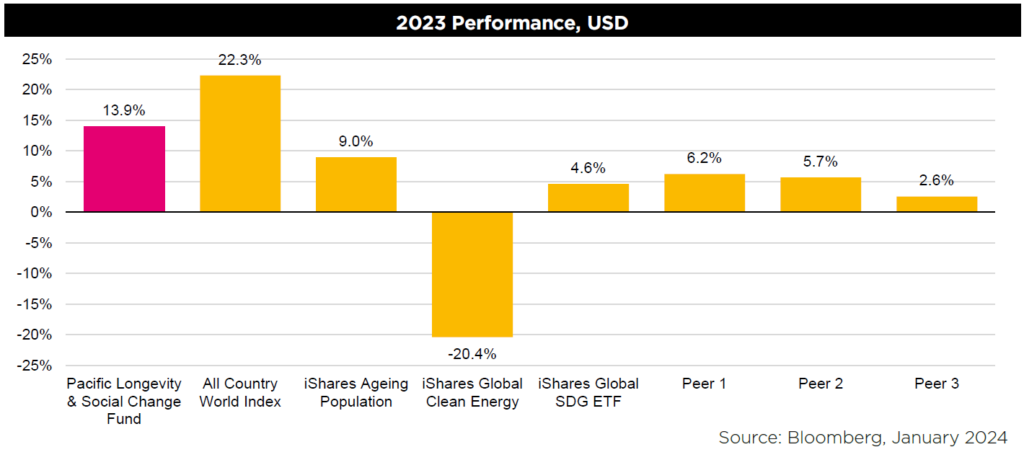

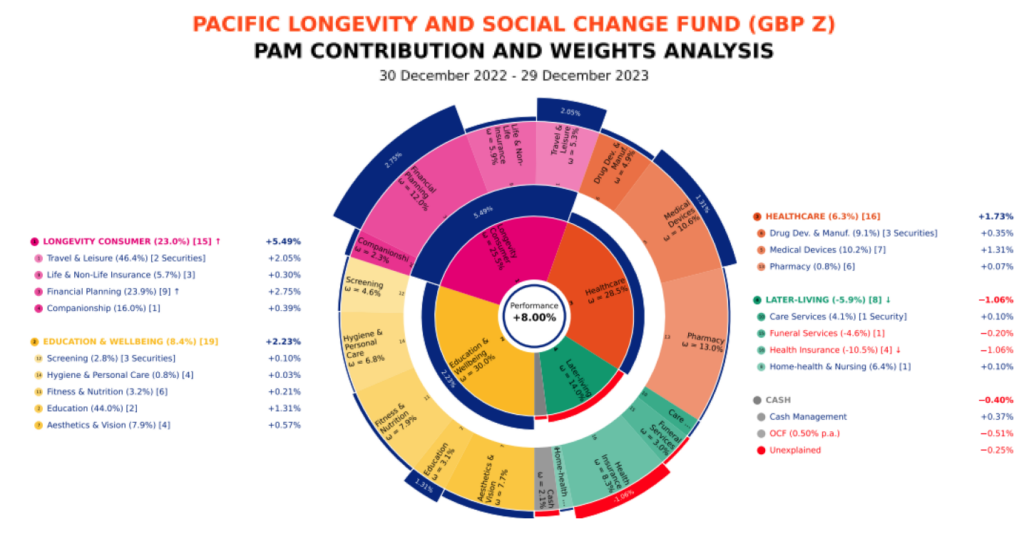

- Despite the Pacific Longevity & Social Change strategy outperforming global equities during Q4, even with its significant overweight allocation to Healthcare, the fund’s zero allocation to Technology throughout 2023, meant the Fund underperformed its long-term reference benchmark of MSCI AC World. With that said, we are pleased to have outperformed our shorter term objectives of peers and ETF equivalent global equity funds (e.g. iShares Ageing ETF) thanks to superior stock selection, particularly within Healthcare and steadfast approach to investing in attractively valued SMID-cap stocks.

- Healthcare ended the year with the worst relative performance since 1999. While it was the third weakest performing sector overall (after Utilities and Staples), recording a 1.8% decline (in GBP), our Healthcare holdings posted a positive 3.1% return. This was driven by Transmedics, Procept Biorobotics and Exact Sciences. Eli Lilly was also a strong contributor as the shares rerated on the news and excitement ahead of upcoming obesity drug launches.

- Our Financials holdings also delivered a strong relative return of 18.8% vs 10.6% for the benchmark, as abating inflation and macro worries drove a rerating in our alternatives holding (ICG & Carlyle Group). UBS, which made progress towards successfully absorbing and integrating Credit Suisse in what looked like an emergency rescue, was also a strong contributor.

- Consumer Discretionary was one of the strongest sectors in 2023, and our positions performed well in relative terms, especially considering our zero allocation to Tesla & Amazon. The two largest contributors to overall performance were Booking, part of the Travel & Leisure subtheme and Adtalem (part of the Education subtheme). The latter is a particularly good example of a stock with a high pureness of exposure to the Longevity theme and should continue to benefit from higher demand for qualified US nurses and physicians as the population ages and currently practicing nurses and physicians retire.

2024 Outlook

As we say goodbye to 2023 we remind ourselves that just because the calendar has rolled over into a new year does not mean anything has changed. Economic trends, themes and markets are all blind to the fact it’s now 2024. Populations around the world are ageing and the social implications around this demographic transformation continues to create significant opportunities for companies that provide products and services that meet the changing consumption patterns driven by this phenomenon. Companies catering to the evolving needs of older generations, from healthcare to leisure, are poised for sustainable long-term growth.

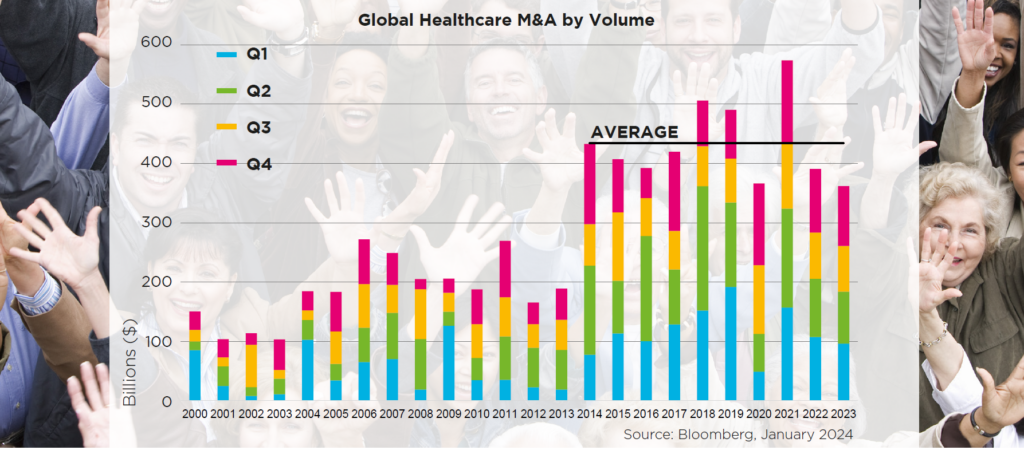

The corporate world echoes our conviction despite high financing costs with 2023 a strong year for Healthcare M&A. We’d argue 2024 will be another bumper year as the need to buy in growth for Pharma only gets bigger and the Medtech and Tools sectors offer the opportunity for attractive tuck-ins (see figure below). If the peak in rates is in, confidence around debt financing and re-financing should provide additional impetus for management teams to pull the trigger.

Equally, we reflect on the positive elasticity of demand for health as global GDP expands. As income increases [and populations age], the demand for health care services also increases. We have written previously about the defensive growth of healthcare (inelastic demand/secular growth through periods of uncertainty) and the industry’s high margins insulated from inflation (given agriculture and energy are not significant inputs).

All bark and no bite

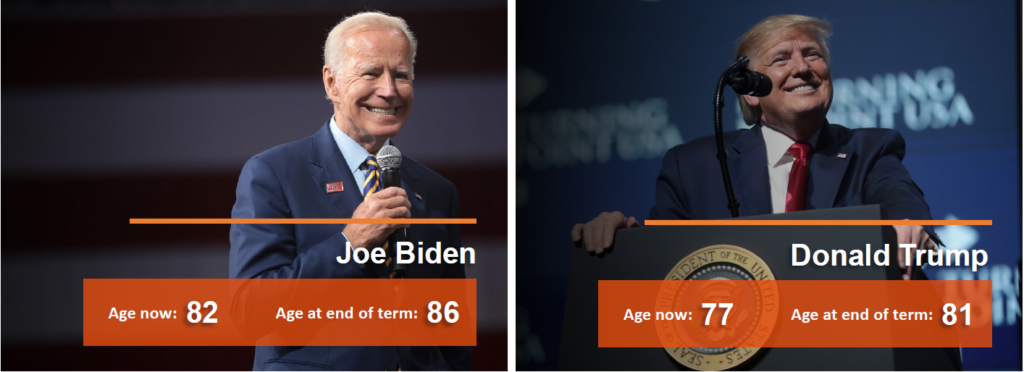

Politicians love to play doctor with drug prices, and with 40 countries holding elections this year, representing 3.2bn people (42% of global GDP) we expect some healthcare hullabaloo. The US, with its upcoming presidential race, will undoubtedly be the main stage with Biden and Trump the leading candidates. With an estimated two-thirds of healthcare industry profits generated in the US, the outcome of the US election will create some turbulence. However, we believe healthcare policy is likely to take a back seat in this year’s election with the primary issues centred on the economy/inflation, immigration and foreign policy. As one Washington expert noted “despite the stark ideological differences between Biden and Trump, neither supports ‘Medicare for all’ and both view drug prices as being too high”. With regards to the former, Democrats will likely defend insurance coverage gains from the Affordable Care Act while Trump will likely criticise Obamacare without offering any viable alternatives. With regards to the latter, the future of the Inflation Reduction Act’s drug price negotiation is more likely to be determined by the courts than by Congress.

A split government also appears to be the most likely election outcome, such that only modest changes to the IRA are likely, thereby removing the traditional election year volatility for healthcare. Meanwhile, with rising incomes and a tight labour market, the demand for healthcare services should continue to increase.

Age is just a number

Joe Biden, the oldest sitting president in history, exemplifies the changing face of our world. He will be 86 by the time he leaves office if he wins a second term (Ronald Reagan was a spritely 77 when he completed his second term), challenging outdated assumptions about ageing. Biden and Trump serve as living testaments to the advancements in healthcare and longevity. It helps to have good genetics with Trump’s mother living to 88 and father to 93. Biden’s mother died at 92, while Joe Biden Sr died at 86 – an impressive outcome considering life expectancy was around 50 for all four parents when they were born. While the mental acuity of both Trump and Biden has been speculated upon, we think voters are ignoring the radical transformation over the past 20-30 years of the population that lives to older ages.

Photo Credits: Gage Skidmore

Still time for something HUMBLER?

This time last year we argued that Big Tech’s dominance was set to end with Healthcare (Biotech, Diagnostics, Genomics, Pharma, Medical Devices) proving its credentials through the course of the pandemic. We maintain the sector will lead the economy in the next 10-20 years, prolonging healthspans, extending lifespans and driving more efficient delivery of healthcare services however, must concede Big Tech’s presence and contribution will still be felt for many more years to come. That said, Healthcare and Consumer Health will become more desirable areas for investment and in turn, an extended wealth accumulation phase from longer working careers will drive increased demand for financial planning and insurance services – notably savings, wealth transfer and annuity products.

Our bottom-up approach, focuses on companies with strong purity to the secular tailwinds of longevity and social change and leads us to continue to build portfolios that are market cap and factor agnostic delivering a differentiated but complementary portfolio compared to more traditional global equity strategies. Ultimately, we believe innovative companies with strong management and a track record of execution should prove to be good long-term investments.