From one bubble to the next

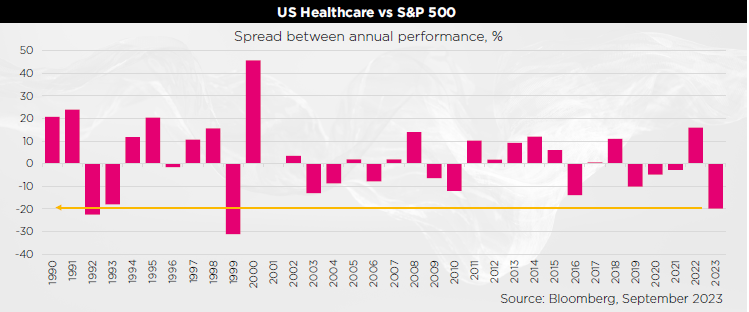

A near 30% increase in oil prices coupled with a sharp increase in US interest rates to multi-decade highs contributed to another stressful quarter for investors. There were few places to hide amidst the market pullback other than Energy, a sector to which the Longevity and Social Change Fund has no exposure. Healthcare did at least manage to outperform a falling market, albeit the US Healthcare sector is still on track for its worst relative performance year since 1999 (see figure below).

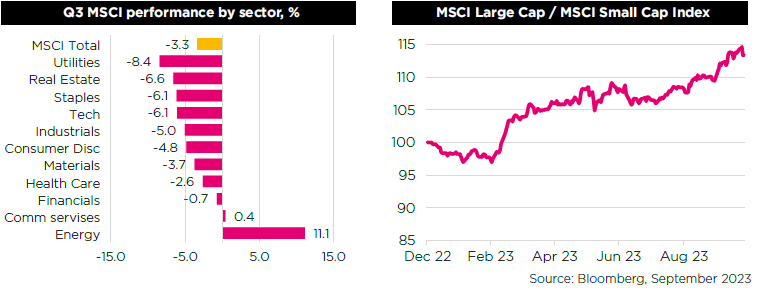

The furore surrounding AI moderated during Q3 after high yields pressured valuations and the market digested the fundamentals behind the theme including possible pace of adoption, monetisation and regulatory backdrop. While Tech led the market declines in Q3, the likes of NVIDIA, Microsoft, Google, Meta, Amazon and Apple still account for over 55% of YTD returns with “size” perhaps partly explaining this phenomenon. Investors appear to be shunning SMID-cap growth stocks in favour of mega-caps with the divergence in performance between large and small-call indices extremely wide.

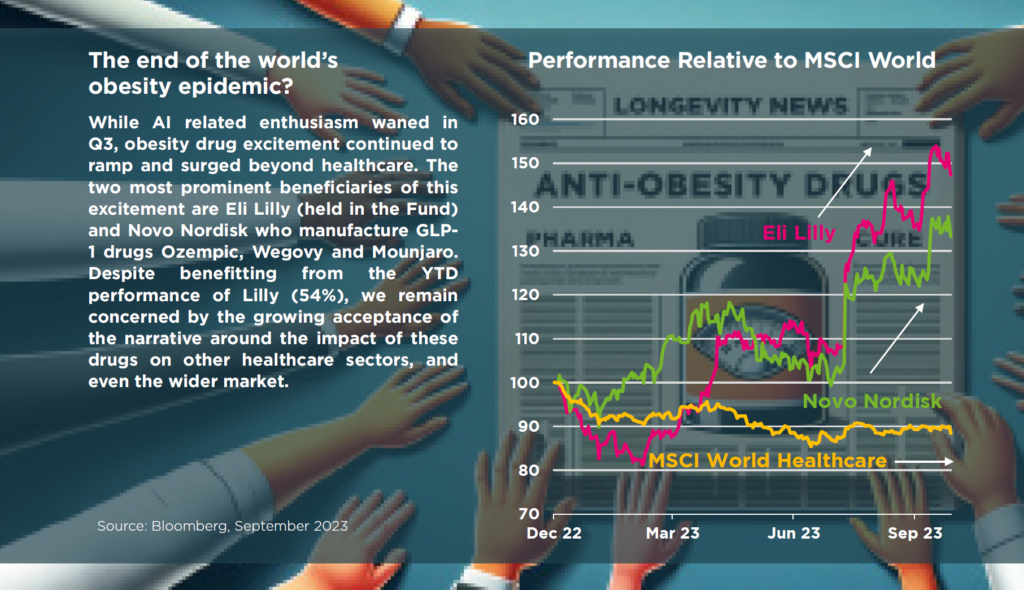

The end of the world’s obesity epidemic?

For instance, Walmart has observed in the small cohort of GLP-1 customers where spending behaviours can be tracked, that these customers are spending slightly less on food while spending more on lifestyle/fitness-related categories such as athletic apparel and wearables technology. Morgan Stanley believe spending on Food At Home could face a material headwind from GLP-1 drug use, given a potential 20-30% reduction in calorie intake. A Jefferies airlines analyst recently discussed on CNBC the fuel cost savings from transporting less heavy passengers.

In our view, the impact of this feels hugely premature, while many obese patients will try GLP-1 drugs, adhering to treatment remains highly uncertain (an analysis published in Diabetes Therapy in May 2021 reported discontinuation rates with GLP-1s can be as high as 50-70% within the first 12-24 months), and once patients stop therapy we know there is significant risk of regaining the weight that has been lost. Unfortunately, the market has taken a shoot first, ask questions later approach with an immediate repricing of growth for multiple Medtech sectors that “could” see a reduction in demand. For example, commentators are arguing patient funnels for insulin-pumps and glucose sensors will shrink as the incidence of Type 2 diabetes declines. Similar predictions are being made around the incidence of kidney disease resulting in reduced demand for dialysis. Will there be fewer hip and knee replacement surgeries as joints carry less weight, will heart valve replacement surgeries stall and demand for bariatric surgery get pushed out? We argue that any impact will take time to emerge and that lowering a morbidly obese patient’s BMI from 40 to 30 still leaves them at a heightened risk of medical complications. We do not believe the world’s obesity epidemic has been solved.

Portfolio positioning and performance

The Pacific Longevity & Social Change strategy marginally underperformed the MSCI World Index during Q3. The lack of exposure to the top performing Energy Sector was roughly equally offset by our zero allocation to the Technology space. The top three absolute contributors to the Fund’s performance in Q3 were Adtalem, Booking and Axonics while the top three absolute detractors were Conmed, Exact Sciences and Hologic.

Looking at the Longevity & Social Change performance by theme, Healthcare was the top contributor, with strength seen in Pharmacy and Drug Development & Manufacturing, more than offsetting weakness in Medical Devices. Horizon Therapeutics, now acquired by Amgen, and Axonics were the top contributors, while Conmed and Tandem Diabetes were the main detractors.

Within Later Living, Health Insurance and Home Health & Nursing offset weakness in Care Services and Funeral Services. Q3 results from UnitedHealth in mid-October reaffirmed that early year concerns were overstated as the company once again beat on expectations and raised the lower end of FY23 guidance. Humana and UnitedHealth were the top performers, while SCI and HCA were the top detractors.

Longevity Consumer also contributed positively to the quarter, driven by Travel & Leisure (Booking) and Financial Planning (UBS). Companionship subtheme was the top detractor as news on upcoming review of the UK Vet sector by the CMA drove a derating in Pets At Home shares. Prudential, part of the Life & Non Life Insurance subtheme, was the top detractor on a stock level. We remain confident in the company’s ability to capture a structural growth opportunity in insurance space in the developing markets though we acknowledge that near term valuation trajectory is likely to be driven by macro newsflow on China, given the significant leverage to trends in mainland visitor travel to Hong Kong as well as a sizeable JV business on the mainland.

Education and Wellbeing was the only theme to deliver a negative quarter as continued strength in Education subtheme was unable to offset weakness across Screening, Aesthetics & Vision and Fitness & Nutrition. This weakness, in its turn, was driven by two primary concerns – the resilience of discretionary spend among the US consumers in face of persistent inflation and resumption of Student Loan repayments and the medium to long term consequences of wider GLP-1 adoption and its consequences on consumption habits. In Retail, shrink was also a highlighted as an ongoing headwind by a number of corporates. On a stock level, Strategic Education, part of the Education subtheme, and Haleon, part of the Hygiene & Personal Care subtheme were the main contributors, while Exact Sciences and Hologic, both part of the Screening subtheme were the main detractors.

Outlook

Forecasts for the timing of the US recession continue to be pushed out, and conditions into year-end and 2024 remain uncertain. Consumer resilience, prolonged monetary policy drag, higher oil prices and geopolitical conflicts all pose concerns. On the positive side, employment remains strong and there are continued signs of normalising inventories, which could provide a short-term boost to manufacturing. While the economic outlook remains uncertain, one thing is clear: the world is ageing rapidly. This demographic transformation is driving profound social change, creating both challenges and opportunities. Companies that can adapt to these evolving trends will be well-positioned for success in the years to come. Our Longevity and Social Change strategy focuses on identifying high-quality businesses that are well-positioned to benefit from this demographic shift. These companies provide products and services that meet the challenges and changing consumption patterns driven by social and demographic change, such as education, healthcare, later-living and financial planning. We believe that these businesses have the potential to deliver attractive and sustainable returns over the long term.