Outlook Snapshot

- 2022 was an incredibly tricky year for markets, and nowhere was this more prevalent than in the sustainable investment space

- We believe there are several key themes to watch for in Sustainable space in 2023, including the energy crisis, politicisation of ESG and regulation

- Sustainable investing has never been more relevant and remains at the forefront of many of the key challenges for society for the coming decades

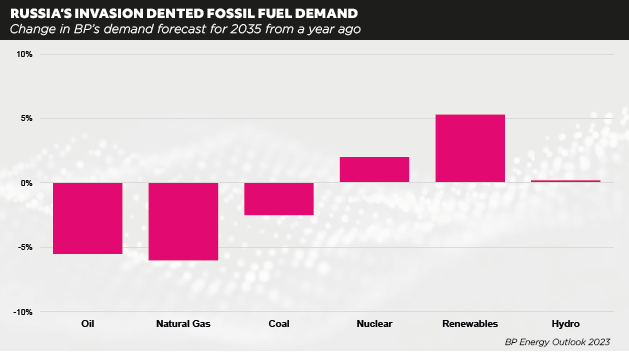

2022 was an incredibly tricky year for markets, and nowhere was this more prevalent than in the sustainable investment space. The spectre of inflation, for many years considered slain by central banks and structural economic factors, rose again. This caused a tightening of financial conditions, as central banks fought to raise policy rates (from record lows), to keep long term inflation expectations in check. Geopolitical volatility as a result of the Russian invasion of Ukraine also caused a shock to the European economy, cutting off Russian natural gas and causing a sharp rise in electricity prices. The real cause of this problem can be traced back however not just to European dependence on Russian natural gas, but also to capital misallocation because of low interest rates, which has led to a lack of investment in electricity infrastructure and power generation capabilities as demand has increased.

At Pacific, we reach several sustainability milestones over the course of the year, including the development

of a sustainable profiling tool, EnlightenESG. EnlightenESG was developed in-house alongside a working group of ESG experts. It seeks to help advisors, asset owners and employers’ profile their stakeholders from an ESG perspective. It serves as a unique tool for ESG investing to meet investor suitability. A respondent gets a personalised ESG profile having undertaken the questions, to help them make better ESG investment decisions. Pacific also further developed its in house sustainability scoring mechanism, launching a database of individual stock and fund scores, leveraging data from TruValue Labs.

Key Themes for 2023

After a frenetic 2022, the start of a new year provides an opportunity to look ahead to some of the key themes for 2023 and for the years ahead.

Energy crises focus the mind

Whilst Europe has thankfully experienced a mild winter, it is likely during periods of poor weather that policy makers will continue to have to make difficult decisions. We have already seen the provision of increased coal power generation in the short term, as the immediate need runs headfirst into the long-term goals of decarbonisation.

We continue to believe that longer term, the pathway for energy independence for many developed markets requires investment in decarbonised solutions, as given current commodities prices and

construction lead times this is the quickest and cheapest way to deploy new electricity capacity. The IEA estimates that $4tn will have to be invested globally for decarbonisation, including investments in new

technologies, greater grid resilience and expansion of existing solutions.

ESG will continue to become politicised and emerging markets will find their voice

One of the key issues emerging is the politicisation of ESG investment strategies in the US. This has been

spearheaded by misguided republican policies aimed primarily at a strawman view of what ESG means to the investment community and what end clients are trying to achieve when investing in sustainable solutions.

There are however hard lessons for the industry to learn amongst this vitriol, including problems around

fees and a need for greater transparency on data, and impact of investment decisions.

For some emerging market economies an increasing focus is on climate reparations, as they stand to suffer most from changes to global climate whilst also having contributed far less in emissions than developed markets. Achieving appropriate payments here is incredibly tricky, as well as defining the model for implementation, but COP27 did begin the discussions on financing this loss and damage.

Social issues continue to become important for investors

Short term, the cost-of-living crisis due to inflationary pressures has placed enormous pressure on the lower income cohort of developed market economies. This could worsen if we see economic conditions deteriorate in 2023. Public policy has shifted slightly to support the most exposed households, a trend we think is likely to continue. Companies further have to consider supply chains carefully as a result of deglobalisation, with COVID and geopolitical pressures proved that ‘just in time’ production methods may not be feasible in a less connected world. Longer term, we think trends related to aging populations will also become increasingly important, as working age populations decline across many of the largest economies in the world, people live longer and retirement planning becomes ever more important.

ESG regulation as a risk for asset managers

SFDR regulation in Europe, designed originally to enable fund investors to better understand the characteristics of their investments has caught asset managers out this year, as in many cases they were forced to walk back their labelling as further clarity on the regulation emerged.

The UK is soon to follow suit, defining their regulatory framework for sustainable investing with the US also expected to release a framework in 2023. The challenge is this comes at a time where sustainable data needs to improve, and the compliance and reporting burden for smaller asset managers remains a challenge. Being conservative with regards to regulation is a benefit, allowing regulatory clarity as this space continues to evolve.

Conclusion

Sustainable investing has never been more relevant and remains at the forefront of many of the key challenges for society for the coming decades. Further, for investors the importance of understanding

sustainability themes remains vital. These range from energy security and the ongoing shift to renewable energy source to social issues and shifting demographics. Our belief is that the landscape for sustainability will continue to be challenging in 2023, however as with each challenge comes the opportunity to further the case for sustainability when investing.