Just when governments and central banks are grappling with the highest inflation for decades, the world has a stark reminder of its biggest challenge ahead: climate change.

The global heatwave is pushing up demand for energy and the price of food making central banks’ jobs even harder. We sit here in the UK in temperatures that are set to reach 40 degrees, the hottest on record. It is of course not just the UK suffering from extremes of heat. Europe is in the midst of a wildfire season that looks set to have not only started earlier than the 2008-2020 average, but also be far larger (some estimates up to 170% greater) in terms of the amount of land razed.

Zooming out, we can see however that these temperatures are not normal, indeed in 1970 the possibility of a 40 degree temperature recorded in the UK was deemed to be a once in a 1,000 year event. This likelihood has now shifted to a once in every 86 years, according to the Met Office’s Hadley Center. Events such as the one we are witnessing now are placing stress on infrastructure, which has simply not been designed to deal with temperatures such as this. Temperatures will also put pressure on economic growth and on the health of people that live in these climates.

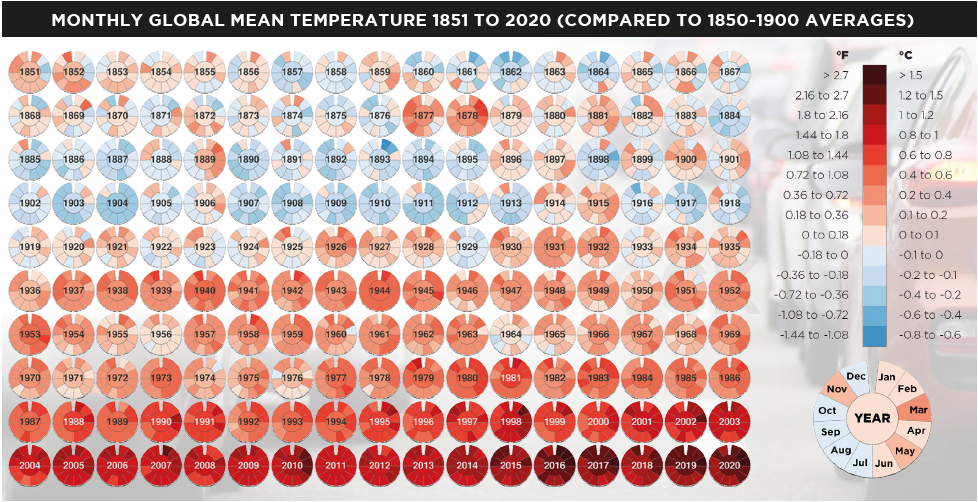

It is startling when we look at global temperatures compared to industrial age averages, as this chart from Neil Kaye at the Met Office shows:

The energy crisis we currently find ourselves in is one of the key drivers that is forcing central banks to act, and forcing governments to rapidly change their energy policy.

Central banks are raising interest rates, hoping to lower aggregate demand and crush inflation, even if this risks

pushing up unemployment and tipping economies into a recession. In the June meeting of the Federal Reserve,

the committee’s statement dropped its previous statement that it expects the “labor market to remain strong” and added the wording “The committee is strongly committed to returning inflation to its 2 percent objective”. This may not sound earth shattering but for the Federal Reserve, this is as clear a statement as they are likely to send. If we take this at face value, they are going to slow the economy to push down demand in the economy and therefore inflation, even if that means pushing the US (and most likely) the world economy into recession in the process.

Government policy has also quickly changed to address this cost-of-living crisis throughout Europe.

Germany, which has one of the greatest exposures to Russian natural gas and has experienced some of the worst of the energy cost increases and potential blackout risk has re-started its coal fired power plants. Some have lauded this as a victory for climate skepticism, as renewables, in their view have not been capable of replacing the fossil fuel infrastructure that has been put in place for much of the 20th century, because of its intermittent nature. We have challenged that view in the past as being overly simplistic, because it is our belief that it is chronic underinvestment in all forms of energy infrastructure, including issues with grid modernisation has made energy infrastructure far less reliable. The IEA estimate that globally $300bn is spent on grid upgrades each year, an amount that has not changed since 2015 and is not adequate to effectively distribute electricity across a country. It means that at the ‘traffic jams’ on the grid are only getting worse. A recent example from Spain is that solar producers in the south

have to turn off production due to low prices whilst natural gas in the north is turned on to meet local demand.

Extremes of heat can also cause problems for fossil fuel energy production. In Germany, the level of the Rhine at the Kaub chokepoint is only 70cm deep due to high temperatures, which means the coal and oil they require for their power plants cannot be floated in enough size to their intended destination. Rising water temperatures also hamper nuclear power plant output. The economic impact of heatwaves is not trivial – with a recent study estimating that the GDP impact of these heatwaves was a reduction in GDP of between 0.3% and 0.5%, due to the reduction in productivity of labour during these periods *

Climate change has the effect of not only increasing average temperatures across the world, but also increasing the volatility of weather, known as ‘Climate Whiplash’.

Planning for climate change of course then becomes difficult, because clearly changes to the system are not linear, higher rainfall one winter may provide more vegetation, which could in turn create more fuel for wildfires in the summer, counterintuitively increasing the need for both flood and fire defences.

POSITIONING FOR CHANGE

Sustainable investing takes into account these changes, investing for this energy transition whilst generating returns for investors.

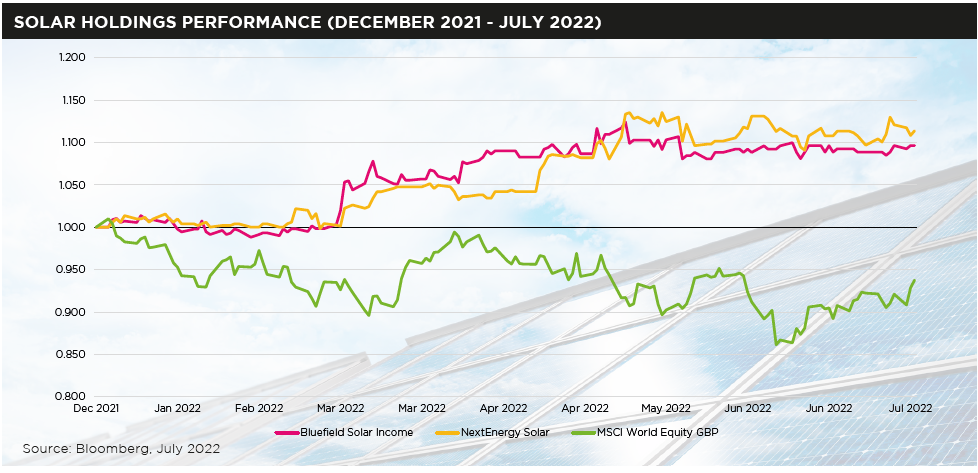

Investing in solar energy infrastructure is one way we do this. These solar producers have government and inflation linked contracts to provide power, which is sold to the grid once generated. Solar is one of the most consistent form of energy production versus other renewables, and at current market prices, it is cheaper to implement per kWh than all forms of fossil fuel energy production. This year our solar holdings have been resilient, despite broader market volatility:

Conclusion

In conclusion, we believe that the energy crisis has huge knock-on implications for policy makers and central banks, exacerbating the inflation crisis we currently find ourselves in. Government policy needs to mitigate the impacts of climate change, but also needs to invest across energy infrastructure as well as energy production to try to minimize these problems. These issues will only get worse as our climate continues to become more extreme because of carbon dioxide emissions.

There are solutions we invest in that include solar producers, that provide an attractive return profile whilst deploying capital into important infrastructure investments to help transition to a lower carbon economy.

* Current and projected regional economic impacts of heatwaves in Europe | Nature Communications, October 2021