Outlook Snapshot

- Risk profiling is the bedrock of the advice process, to ascertain a clients willingness and ability to take investment risk and recommend an appropriate investment vehicle.

- More recently, as sustainable investing has become key to the advice process, Pacific has developed a tool to quantify a client’s attitude to sustainability, and understand where on the ‘green spectrum’ they sit.

- We can aggregate the data we have access to, and utilise it to generate an ESG sentiment indicator. This shows us how clients attitudes to sustainability are shifting through time.

- We see that more recently ESG sentiment has deteriorated, which has coincided with a period of underperformance for sustainable strategies. By creating EnlightenESG we hope to have contributed to the sustainable investing ecosystem and help clients to invest based on their true views on sustainability, not just on the basis of recent performance.

EnlightenESG

Many years ago, advisors started to ask their clients detailed questions about their attitude to risk and these days risk profiling is part of almost every advisor’s toolkit. Now that sustainable investing is becoming an important part of the conversation with clients, at Pacific we decided to build something for advisors to quantify their clients’ attitude to sustainable investing; from that simple idea EnlightenESG was born. The idea behind EnlightenESG is to identify how far along the ‘green spectrum’ they might sit. One of the surprise benefits of implementing this technology has been giving us a large data source to assess overall attitudes to sustainability, and from this we can develop a sentiment indicator to see how sustainable views are changing through time.

EnlightenESG – The beginnings

A couple of years ago, we were discussing the importance of environmental, social and governance factors in investing, and the emergence of a raft of clients that were seemingly interested in investing in a more sustainable way.

Our view at the time was that this was clearly a good thing: investing in companies that consider these factors, means that those companies will be more likely to be able to adapt to the rapidly shifting competitive landscape, less likely to take significant regulatory risk, as well as have a lower impact on the planet’s finite resources.

However – we are not naïve, we also appreciated that this coincided with a period of strong returns for ESG strategies, and many exciting stories were appearing from the asset management community itself.

Due to client demand, we developed a sustainability risk profiler, to attempt to identify where on the spectrum of ‘green-ness’ an individual sits.

The concept of risk profiling has been around for many years, an investor is asked a series of questions to help understand both their ability and willingness to take on investment risk, and the returns taking this risk can generate. This can help people understand their long-term financial goals, the likelihood of reaching them and plan for their futures.

We built EnlightenESG to be another consideration in this calculation: in addition to the question of how much risk a client should take, Enlighten helps to frame where should I sit along the sustainable investing spectrum.

How does EnlightenESG assess sustainble preferences?

The question of how we assess an individual’s sustainable preferences is through a series of simple questions. We break down the questions into three broad categories:

- Lifestyle: what changes have you made in your day-to-day life to better reflect your sustainable preferences

- Policies: how philosophically do you feel about sustainability issues with regards to company behaviour

- What-ifs: how would you feel if your investments performed differently to conventional multi-asset approaches

Each question within the questionnaire is also scored on a relative basis, in other words, it is normalised versus the peer group average of previous scores. The process is designed to learn and adapt as the world, and people’s views change. It is also designed in this way because we want to think about sustainability as relative to societal norms at a given point in time. If over time everyone recycles, your decision to recycle doesn’t show that you are more sustainable than the norm.

The result is then very simple, a profile score from Citizen through to Impact, ie from lightest to darkest green.

Overall Profile Score

Generating a Sustainable Sentiment Measure

We have been running this technology for clients for over a year, and as a result we get some fascinating sustainable data on participants. We anonymise all respondent’s information, and aggregate individual results to track views on Sustainability through time.

We can track whether certain age groups are more interested in sustainability than others (hint: the oldest and youngest generations are). We can also track whether cohorts of people are more interested in the E, the S or the G at any given point in time. The most recent data we ran points towards a shift towards social considerations as being the most important for respondents, which is possibly a reflection of the burden of several governments facing inflationary pressures and a cost-of-living crisis, a lot of which will be borne by the lowest income bracket.

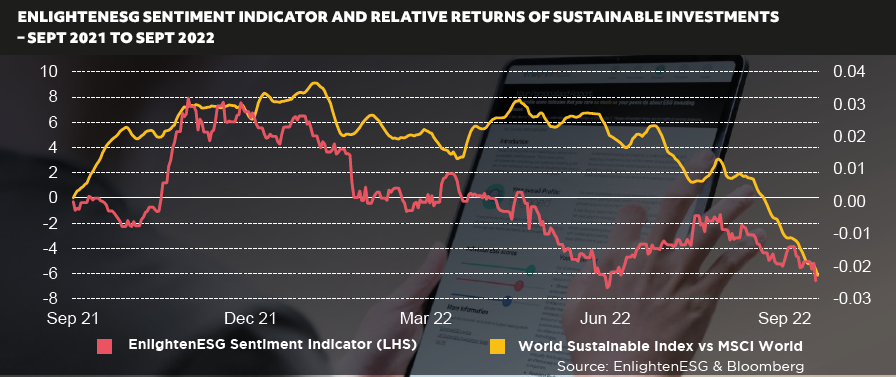

Most importantly though we can also create at a generalised view of ESG sentiment. We create a simple average of how each person answered each question (ie whether they were above or below the peer-group average), and we map their aggregate answers through time. We recently ran this data for a conference, and the results were very interesting as we see from the chart below. We see that, through most of 2021, since we started collecting this data ESG sentiment was broadly positive, above our averages. However, more recently ESG sentiment has started to reduce.

When we chart this next to the relative returns of a simple World Sustainable index relative to a market cap index we might be able to see why – Sustainable strategies have gone through a period of under-performance for much of the year. If you combine this with the politicisation of sustainability, with many people questioning the short-term importance of environmental policy given the Russian invasion of Ukraine and subsequent energy crisis in Europe (wrongly in our view), as well US politicians blaming ESG for inflation, and we feel it is unsurprising that sentiment will have fallen.

However, as is often the case with investing sentiment, perhaps declining sentiment is in a sense a good time to ‘buy’ sustainability. We know that with this falling sentiment some of the people that were more focused on short term relative performance may have moved away from sustainability, which has been challenged. This however, means that those remaining in sustainable investment options are more patient capital, willing to diverge from the index, whilst investing in aggregate in better companies.

We continue to believe enormous structural drivers that over the long term should benefit sustainable investment. In fact, we have a greater requirement now, in a de-globalising world to invest in sustainable infrastructure, and to be more aware of our supply chains and social considerations of companies.

Conclusion

For Pacific, EnlightenESG allows us to track sentiment of sustainability at the aggregate level. We can utilise the

relative return of sustainable strategies versus conventional market cap indices to explain some of why we see

sustainable sentiment deteriorate. Most importantly, we hope that by creating EnlightenESG that we have contributed to sustainable investing, helping clients to invest based on their views on sustainability as well as risk, and not just on the basis of recent performance.