As the economic impact of a global pandemic begins to fade, markets now have war to contend with. Volatility and uncertainty are increasing and so diversification has never been more important.

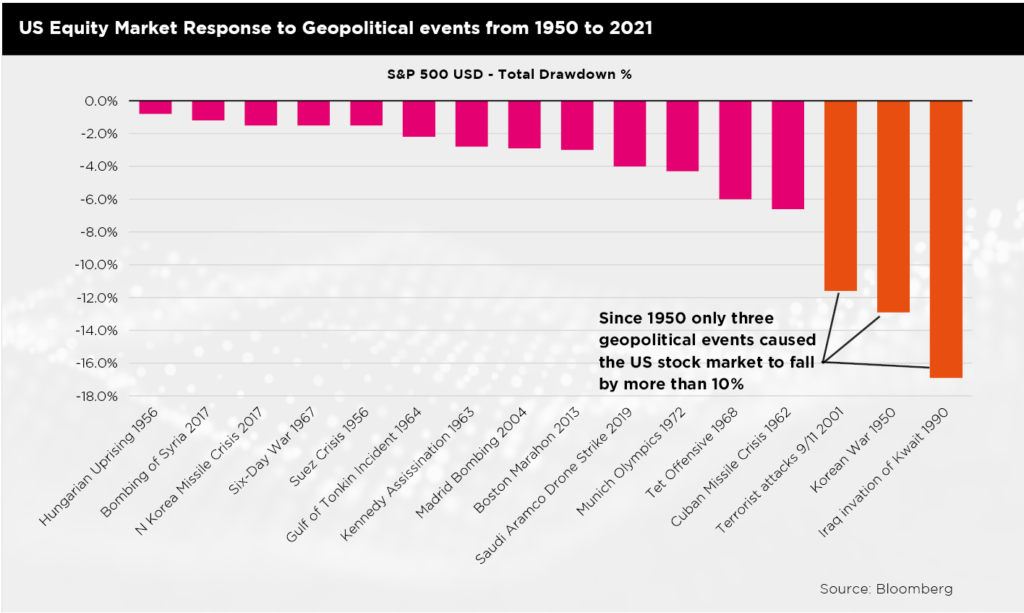

The key event of the first quarter was the shocking invasion of Ukraine. Equity markets responded to the horrendous scenes with plunging markets as the collective horror of investors was reflected in market volatility. It would therefore seem obvious that it was solely this event that was the cause of negative returns from equity markets in the first quarter. However, what we actually saw was that equity markets then rallied from the middle of March to recoup all of the losses that occurred in the days following the Russian invasion of Ukraine. Whilst this may sound surprising, and somewhat heartless, this echoes the equity market response to most of the major geopolitical events of the last 70 years. During that period, only three geopolitical events caused the US stock market to fall by more than 10%:

Barton Biggs, the late Morgan Stanley strategist wrote a book chronicling markets in the 20th century called Wealth, War and Wisdom. He made the following observation about stock markets during the Second World War: “I discovered that the British stock market bottomed for all time in the summer of 1940 just before the Battle of Britain; that the US market turned forever in late May 1942 around the epic Battle of Midway; and that the German market peaked at the high-water mark of the German attack on Russia just before the advance German patrols actually saw the spires of Moscow in early December of 1941. Those were the three great momentum changes of World War II — although at the time, no one except the stock markets recognised them as such. This, to me, confirmed the extraordinary (and unrecognised) wisdom of market crowds.”

The lessons from investing through geopolitical events over the last century still stand: don’t panic and remain

diversified. The geopolitical events that caused greater market falls are those that had knock on effects on the global economy.

Inflation from textbooks, to headlines to reality

In the case of Ukraine, the greatest impact will be to put upward pressure on inflation, causing further headaches for central bankers. Since the tail end of last year, central banks have tightened monetary policy with increasing urgency as inflation has moved from a word in economic textbooks describing the 1970s, to headlines in newspapers warning of a “cost of living crisis”. Inflation has intensified in the US, with Consumer Price Inflation doubling over the last 12 months to 8.5% as supply chain disruptions, higher demand for goods and a surging oil price have pushed up prices.

Looking under the surface, the number of sectors seeing inflation has been broadening and the severity of price rises has increased. Wage inflation is failing to keep up with costs, causing further consternation amongst workers, but this too is moving higher, further fuelling concerns for central bankers. Jerome Powell, Chair of the Federal Reserve stated that “inflation is much too high” and vowed to “take the necessary steps to ensure a return to price stability.” Bonds took fright, with US Treasuries falling the most in one quarter for ninety years.

The war in Ukraine clearly increases inflation risks

With Russia having been the largest exporter of oil to global markets last year. Europe, with its dependence on

energy from Russia, which accounts for 55% of Germany’s natural gas for example, is most affected. Russia was also the world’s largest wheat exporter, accounting for around 30% of global exports when combined with Ukraine. Food price rises not only put upward pressure on inflation, but also increase the likelihood of civil unrest, as often food shortages trigger rioting, as we’ve seen in China recently.

Building portfolios resilient to rising inflation

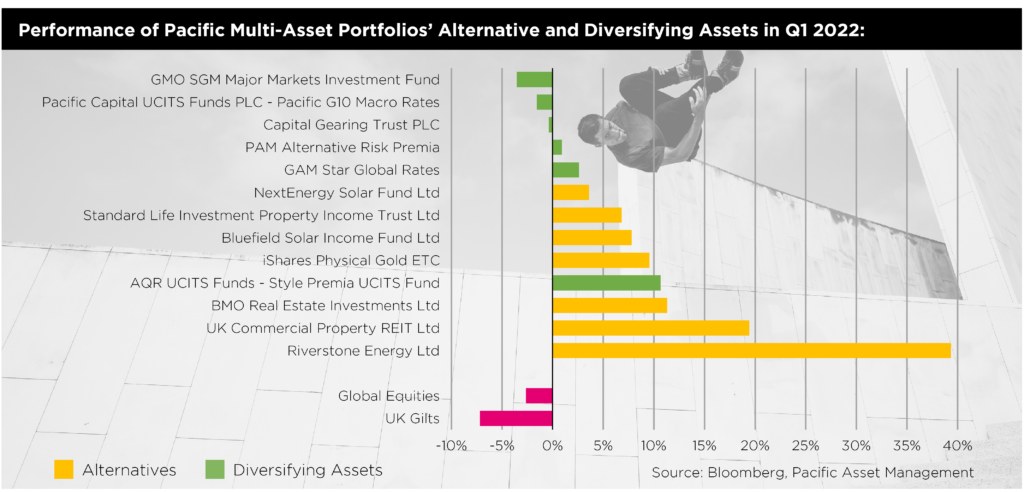

Given these increasing risks, it is important to build portfolios that are resilient in a higher inflation environment.

History teaches us that value stocks typically outperform during these periods, as do alternatives, gold, infrastructure, and real estate. These have all been major drivers of returns for our portfolios in the first quarter.

The other impact of the war in Ukraine is as a dampener on economic growth. Again, Europe is most affected due to the impact of higher energy prices on consumers and businesses, because of its historic trading with Russia as well as the sanctions it has put in place itself, along with the global community. Given risks of slowing global growth, we feel it is more important than ever to be alert to signs that this slowdown is continuing, and we may see ‘late cycle’ dynamics. Whilst some parts of the world are clearly impacted by this, other areas will fare better, particularly those that are energy independent such as the US and Canada. Commodity exporting countries, including those in Emerging Markets, are likely to be beneficiaries of elevated commodity prices. This reinforces our view of the importance of being globally diversified.

Conclusion

The impact of the war in Ukraine has sent shock waves around the world and brought geopolitical risks to the fore. Market volatility has soared with equity markets gyrating whilst government bonds have responded to the hawkish tones from central bankers who are firmly in inflation fighting mode. We think there are opportunities in the cheapest parts of the equity markets and in alternatives such as listed real estate, commodities and gold, many of which haven’t participated in the last decade of extremely loose monetary policy. Finally, the world is becoming ever more uncertain and so diversification is more important than ever.