- The Federal Reserve has a dual mandate, price stability and full employment. However, the Fed is now determined to crush inflation, even if this risks pushing up unemployment and tipping the economy into a recession.

- The likelihood that the Federal Reserve can engineer a soft landing is slim, three quarters of rate hiking cycles end in a recession. However, consumers and companies are less leveraged than they have been in previous cycles and so a mild recession is more likely, if it occurs.

- We seek shelter from this slowing growth through defensive equities, that are less economically sensitive and have robust balance sheets and through a variety of diversifying assets and alternatives, that can continue to perform despite the recent struggles in both equities and fixed income.

- Price stability around 2% inflation.

- Maximum sustainable employment.

Source: Pacific Asset Management, July 2022

Should we take their word for it?

In the June meeting of the Federal Reserve, the committee’s statement dropped its previous comment that it expects the “labor market to remain strong” and added the wording “The committee is strongly committed to returning inflation to its 2 percent objective”. This may not sound earth shattering but for the Federal Reserve, this is as clear a statement as they are likely to send. If we take this at face value, they are going to slow the economy to push down demand in the economy and therefore inflation, even if this risks pushing the US (and most likely the world) economy into recession in the process. Fed Chair Jerome Powell confirmed this view by saying that failure to restore inflation stability would be a “bigger mistake” than tipping the US into a recession, which in his view can be avoided.

For observers of the Fed, this is a shocking departure from form. For the last 25 years, every time there has been a whiff of a slowdown, the Fed has ridden to the rescue with ever increasing force by slashing interest rates and engaging in ever larger QE programs. Previously, this Fed reactiveness to market performance – called the ‘Fed Put’ has led market participants to ‘buy-the-dip’, a strategy that worked until it didn’t this year. However, because of the cost-of-living crisis and in the interest of maintaining their credibility, they are going to have to continue to be tough on inflation and raise interest rates aggressively until inflation returns to more palatable levels.

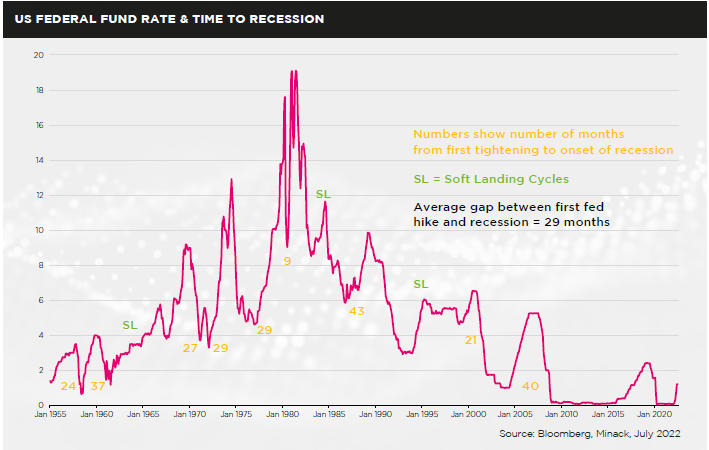

The chart below shows the history of Federal Reserve hiking cycles going back to 1955.

The good news is that there have been times when the Fed has raised rates and engineered a soft landing; the bad news is around three quarters of rate hiking cycles have ended in recession.

It is worth mentioning that the timing and severity of those recessions has varied greatly, depending on broader

macroeconomic factors such as debt levels and imbalances that have built up prior to the slowdown.

The markets in recent times have also been flashing warnings signs in terms of various major asset class performance. Equities have been falling, but interestingly so far this has mainly been due to valuations contracting, as opposed to earnings falling. Typically, during recessionary periods we see earnings falling by around 15%, but as yet analysts’ expectations for earnings have barely budged.

Bonds, reacting to a hostile central bank and inflationary pressures were selling off across maturities, but more recently at the longer end have started to rally, indicating that there is scant belief that the Fed can continue raising rates into a significant slowdown in economic activity.

Finally we are also seeing that one of the pivotal causes of the high inflation environment has started to come unwound, which is the commodity complex. Industrial metals, often seen as a bell-weather for global growth given their uses in manufacturing, have fallen some 39% from their peak after the invasion of Ukraine. Broader commodities have also joined the sell-off, as growth concerns globally stoke the fear of demand destruction.

So where do we go to find shelter when several of the major asset classes are underperforming?

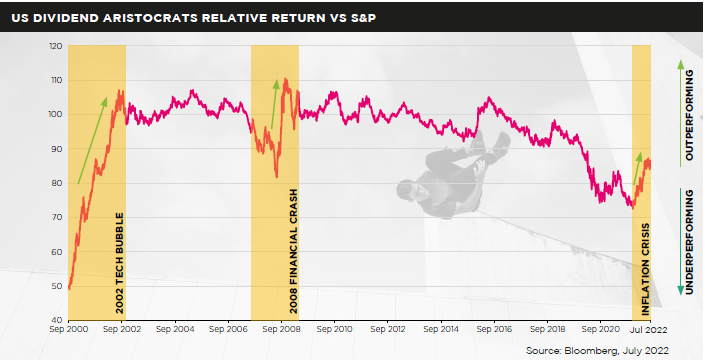

Firstly, it is worth remembering that not all equity markets react equally during times of inflation and times of growth stress. Some equities have cash flows far out into the future, with earnings that are reliant on growth from today’s levels, whereas others, that are able to pay a dividend have more visibility of their short-term earnings. One such subset of the equity market that we have been investing in is the Dividend Aristocrats, strong balance sheet companies that have been able to maintain or increase their dividend over the last twenty years, through multiple economic ups and downs.

The next chart shows the performance of Dividend Aristocrats relative to the broader S&P 500.

When the line is rising Dividend stocks are outperforming and are underperforming the broader market when the line is falling. What is interesting about these companies is that they tend to outperform when markets are going down, but also, and crucially, they tend to keep up when markets are rallying, such was the case coming out of the tech bubble in 2002 and the GFC of 2008.

The other way we can handily diversify away from these risks is through exposure to Alternatives and Diversifying assets. We have identified several strategies that have a low correlation to both equities and bonds through the market cycle. So far, these holdings have been very resilient to tough market conditions, indeed in the case of some strategies they have managed to generate strong positive returns.

Finally, cash, despite being a depreciating asset in real terms is a helpful tactical asset during periods of market volatility. We utilise cash and have been flexing our weight to this asset class to reflect our views on growth deterioration. We can also utilise foreign currencies, such as the Japanese yen which is historically cheap, and has a history of being a safe harbour, tending to strengthen versus other currencies during these periods of market stress.

Conclusion

It is clear to us that the change in rhetoric and decision to confront the inflation problem from the Federal Reserve is likely to cause a growth slowdown, and if history is a guide, could cause a recession in the near future. Several asset classes, including equities and commodities are flashing warning signs that there may be an impending growth slowdown. In this environment it is vitally important to remain diversified, and to have sources of returns that are less correlated to assets exposed to these growth pressures.