- The first quarter saw the failure of a number of small regional US banks; however, markets remained resilient.

- Longer term, we think this will make banks less willing to lend which is likely to impact on growth.

- Central banks are in an awkward spot: inflation is still too high, whilst the risks of a slowdown have increased.

- We have moved portfolios to be more defensively positioned, with positions such as inflation linked bonds and curve steepeners likely to benefit in a growth slowdown.

- In time of heightened uncertainty, it remains important to be diversified and active in asset allocation.

Outlook

Headlines of bank failures hardly seem like the backdrop to calm markets, and yet the first quarter scorecard shows both bonds and equities were positive. Under the surface, things are not quite what they seem: the issues with the banking sector are unlikely to spiral out of control in the short term but are likely to weigh on growth in the long term. And whilst major equity indices have been rising, some of the more economically sensitive areas of the market, such as small companies and cyclical sectors haven’t participated in the rally, suggesting a less bullish picture. Macroeconomic data also appears inconsistent, with stronger data for US retail sales and progress on inflation conflicting with weakening hiring intentions and lower new orders confidence for smaller businesses.

The key narrative for the first quarter was the liquidity crunch which emerged within the banking sector. It started with the failure of Silicon Valley Bank (SVB) and Signature Bank in the US. Failures in smaller, regional banks are not uncommon in the US (that has over 4,700 banking institutions), however SVB was one of the largest by deposits that has failed. SVB suffered three key issues, that made it particularly susceptible to a bank run:

(i) It had a concentrated base of depositors, many of which were focussed on the technology sector, and had deposits that exceeded the FDIC’s insured level of $250,000.

(ii) It relied heavily on deposits and financial securities as part of its business model and less on loans.

(iii) It did not hedge the interest risk of these financial securities.

This unique set of risk management failures led to its downfall and shook depositors’ confidence globally. The corollary of this was that deposits began to take flight from any bank perceived as being weak. This phenomenon was transatlantic, and resulted in a liquidity crisis at Credit Suisse, which was then taken over by UBS at the behest of the Swiss National Bank. Regulators acted swiftly, with US Regulators stepping in to assure SVB depositors that their deposits would be fully insured, and also by creating a bank term funding programme, designed to ensure that banks with similar asset problems as SVB have access to short term liquidity to meet any deposit withdrawals.

Policy makers are caught in a bind: if they do not hike rates enough, they risk inflation becoming structurally higher than target and embedded in the expectations of consumers. However, raise rates too much and not only could growth slow, but a recession becomes the likely outcome. Central banker’s jobs have become even more challenging with the impact of the banking crisis on the availability of credit. The longer-term consequences of the banking liquidity crisis will likely be that banks will be less willing to make loans to the different parts of the economy.

Whilst we have mentioned above that the failure of smaller banks does not matter in isolation, the cumulative impact of their lending is not to be understated. In fact, smaller banks in the US provide roughly 50% of commercial and industrial lending, 80% of commercial real estate lending and 60% of residential real estate lending. Whilst we do not forecast that there will be a ‘sudden stop’ in the system, the lower provision of loans will cause a hit to GDP. In our view, this increases the likelihood that the global economy slips into recession.

Portfolio Positioning

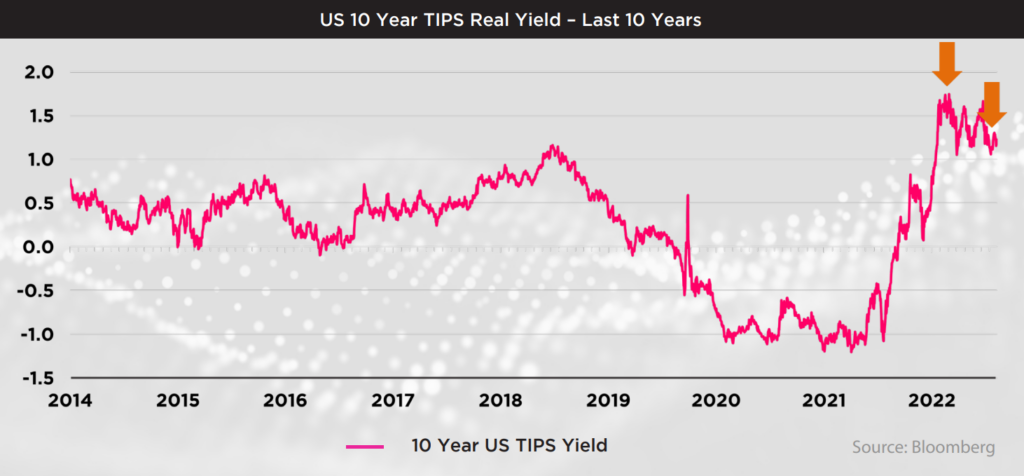

It will be unsurprising to hear that we have moved towards a more defensive stance within portfolios, having been dynamic in our positioning for much of 2022 in the face of hostile bond and equity markets. Whilst remaining underweight fixed income and maintaining little to no exposure to the riskiest areas of credit markets that remain vulnerable to a growth slowdown, we have been adding to positions in inflation linked bonds in both the US and the UK since Q4 last year. These bonds offer protection from the prospect of a growth slowdown, as their duration component will likely rally in a period of weak economic growth. Also importantly, if central banks fail to rein in the inflationary pressures that have been present in the post-COVID world, the in-built inflation protection from these securities will add value. Below we chart the real yield of the US 10 Year inflation linked bond, with arrows indicating our purchases.

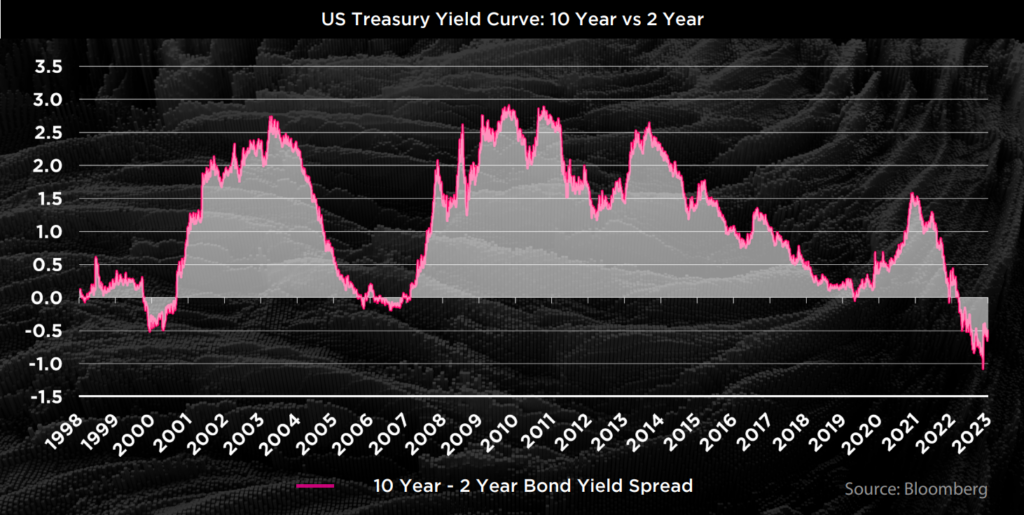

We have also been adding to a position that is linked to the shape, rather than the level of the US Treasury yield curve. The US 2-10 Curve Steepener goes long 2-year government bonds, and short US 10-year bonds, weighting each exposure to their duration risk. The shape of the yield curve serves as an important signal about the future state of growth, and when it is inverted (ie the 2 year yield is above the 10 year yield), this serves as a reliable early warning recession indicator. This has been the case since the middle of 2022. However, it is when this curve starts to shift higher (and the 2-year yield starts to fall faster than the 10-year yield) that the market senses that economies will experience a growth slowdown and central banks will have to reverse course. In the chart below we show this relationship between the 2-year bond and the 10-year bond, and we see that in both the recession induced in 2000 and 2008 the 2-10 Curve steepened by over 250 basis points.

Conclusion

Despite scary headlines, markets have remained reasonably orderly during the first quarter, but our concerns point to a longer term lowering of credit provision by banks, as they seek to shore up the liability side of their balance sheets. This could cause knock on impacts to the real economy, as it likely lowers the path of growth for major economies including the US.

We continue to position portfolios for this scenario across a diversified mix of asset classes and strategies, to cushion portfolios should equity markets turn down. Economic slowdowns also tend to throw up some of the best long-term opportunities, which we want to be able to take advantage of. Trades such as TIPS and curve steepeners also have a range of outcomes in which they can perform positively, with limited correlation to equity markets. In an uncertain and rapidly evolving environment, diversification has never been more important.