- Central banks in developed markets have begun cutting interest rates as inflation normalises, though higher-than-expected UK inflation highlights ongoing challenges. The speed of future cuts will depend on factors such as labour market resilience and growth dynamics.

- While headline inflation is close to targets currently, sticky components and stronger than expected growth could reignite inflation concerns, which is a less positive environment for risk assets.

- In China, fiscal and monetary measures, including real estate support and market interventions, aim to stabilise growth and restore confidence.

- These policy shifts have bolstered Chinese equity markets, and further fiscal measures could drive additional positive re-ratings.

Outlook

The interest rate cutting cycle has begun. How far central banks can cut rates depends on the resilience of the labour market and whether inflation has been fully tamed. This cycle still has the potential to surprise.

After the fastest tightening cycle since the 1980s, economic growth in major developed markets remains above trend, and the labour market has come back into balance, after a period of excess demand in the service sector of the economy. Inflation has normalised at the headline level, however it remains sticky in parts, including services across many nations and particularly in the UK.

Central Banks

Major developed market central banks have now moved to cut interest rates and have signalled that there is more to come. Among the big three, the ECB kicked things off with a 25bps cut in June, followed by the Bank of England in July, and the Federal Reserve with a 50bps cut in September. This response reflects the drop in inflation and concerns that, on a forward-looking basis, if the labour market continues to slow, it could tip into recession, even though this does not show up in the data for now.

Have central banks achieved the fabled soft landing, where, despite monetary policy tightening, economies avoid recessions and inflation normalises? This is typically a very strong outcome for risk assets, an occurrence that has historically happened in only about one in four tightening cycles. It certainly seems that way, which is one of the reasons why risk asset returns, such as equities, have been very strong throughout 2024.

All eyes on labour markets

However, we are not fully out of the woods yet. The answer to how this cycle ends lies in the evolution of the labour market. So far, we have seen a slight pick-up in unemployment from record low levels (3.4% in the US). However, we have not seen widespread evidence of weakening. Measures such as the layoff rate, a measure of the rate of people being made unemployed, remains very low, and payrolls, which measure job creation in the US, remain resilient. We appear to be in a ‘no-hire, no-fire’ jobs market. Given that businesses in some sectors struggled to recruit after the disruption of COVID, they are unwilling to lay off workers, particularly while their profits remain robust. It is vital to monitor the evolution of the labour market for signs of weakness to determine if a soft landing is achievable.

Inflation

Another scenario worth monitoring is that inflation, which is now close to central bank targets, could reignite if growth is too strong, especially as measures like rental inflation remain elevated. This would risk a repeat of 2022, where both bond and equity returns were negative, although bond yields are starting from a much better place than the record lows at the start of the 2020s.

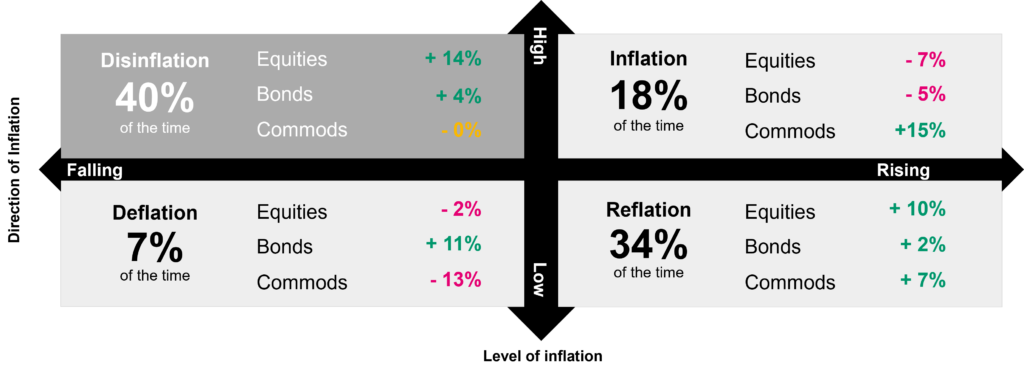

Inflation regimes 1926-2022

Source: (MAN Institute, Pacific)

A study by the MAN Institute shows the negative impact of high and rising inflation in the top right-hand quadrant of the table. Whilst we currently sit in the disinflation portion of the distribution, it remains important to be vigilant for signs that these sticky components of inflation cause market concerns. .

Fiscal Firepower

Another factor that has potentially changed the outlook for global growth is news from China. Both the central bank and central government announced that they would use fiscal and monetary tools to address the real estate sector slowdown, and ensuing domestic demand slowdown, which has reduced growth and sparked concerns of outright deflation. First, the central bank announced that it would cut central bank rates and lower mortgage burdens on consumers, however this was met with a muted market reaction. As is often the case in the collapse of housing bubbles, people are unwilling to borrow further when prices are falling. However, an announcement from Pan Gongsheng, Chairman of the PBoC, did move markets. He indicated that the Chinese regulator was going to set up a facility that would enable financial institutions to step into the market and purchase equities, and that corporates could borrow to buyback shares of their own businesses.

Further, the next day, at an unscheduled Politburo meeting – President Xi announced a package of fiscal measures that would “halt the declines” in the housing market and contain “efforts to boost the equity market”, indicating that stabilising employment was a priority.

Whilst the details and size of the fiscal spending has yet to be announced, this three-pronged attack shows that the Chinese authorities understand that they need to address the weakness in the economy and shore up confidence in the stock market.

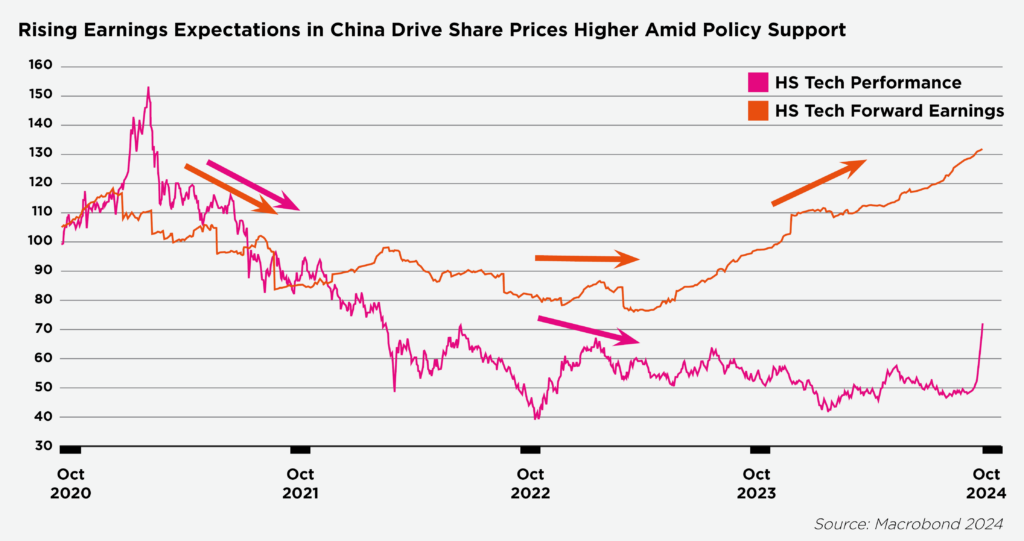

The chart above shows the performance (in pink) of the 30 largest Chinese technology companies listed in Hong Kong versus their forecast earnings (in orange). We established a position in an ETF tracking these Chinese technology companies in January of 2024, as we noted that valuations on a price earnings basis had fallen to half of that of their US peers. For much of 2022, this was due to earnings falling, as Chinese regulators cracked down on technology companies as well as the malaise the economy found itself in. However, at the midpoint of 2023, forward estimations to earnings started to pick up. We then saw signs of ‘blood on the streets’ as macro hedge funds reported liquidations and retail investors threw in the towel. For us, this was a time to add a small position, which we increased in April.

Upon the announcement of the fiscal and monetary news, Chinese technology companies rallied rapidly. Given the extreme volatility (mostly to the upside) we have traded around this position. However, we remain excited about owning cheap assets with improving fundamentals, that are under-owned and have a clear catalyst for a positive re-rating.

CONCLUSION

Developed market central banks have determined that enough progress has been made on inflation to cut interest rates. The speed of cuts will be determined by their view of the unfolding inflation and growth mix. We believe that the clue to whether they can stick the soft-landing lies in the evolution of the labour market data. Typically, rate cuts without a recession are positive for growth assets. China has also loosened policy, announcing a raft of measure to combat a slowing consumer sector and housing market. These policies have proved positive for risk markets in the area, and we believe there could be a further re-rating if fiscal measures continue to be unveiled.