- The US economy remained resilient in 2024, with strong consumer spending and central banks cutting rates, though inflation remains a challenge.

- Donald Trump won the 2024 presidential election, with policy priorities including tax cuts and deregulation, which could boost growth but also increase inflation risks.

- The US stock market significantly outperformed global peers, driven by corporate earnings, AI advancements, and policy support, though high valuations pose future risks.

- Historical market trends suggest US dominance is not guaranteed, and other regions may present investment opportunities over the long term.

Outlook

We start a new year on the back of a strong year for risk assets in 2024. Economic growth, particularly in the US, remained resilient, as US consumer spending remained robust. Central banks started cutting rates in the third quarter, acknowledging that they had made material progress on returning to a benign inflation regime, and that whilst economies remain at full employment, their monetary policy remains restrictive. The Fed, having cut rates three times, announced a pause at the end of the year, acknowledging that sticky components of inflation remain a challenge.

Donald Trump secured a decisive victory in the 2024 US presidential election, defeating Vice President Kamala Harris. Trump won both the Electoral College and the popular vote, and the Republicans won control of the Senate and the House. Trump campaigned on five major policy areas: tariffs, immigration, tax cuts, government spending cuts and deregulation. Whilst it is early to tell, undoubtedly the pace at which Trump has begun his second term is far quicker than the first, and the policy mix could support growth, but it could also lead to inflation. Further, the range of outcomes is incredibly wide, particularly with areas such as government spending cuts, which could ease the debt burden but damage the growth trajectory of the US economy. So whilst the outlook for global growth remains reasonably positive, there is increasing uncertainty.

American Exceptionalism Forever?

In the last quarter of 2024, the S&P500 outperformed the rest of the world by one of the largest margins we’ve seen. For many investors, this is just seen as business as usual. After all, the US stock market has pulled off this trick for 13 of the last 15 years and for 7 years in a row. Has it deserved to achieve this feat? Absolutely. In the short term, US markets were buoyed by the promises of corporate tax cuts and deregulation from President Trump, and the AI theme, which has been lifting earnings expectations. Longer term, equity market returns are a combination of returns from corporate earnings and changes in valuation, and on the earnings front, US corporates have trounced the rest of the world since 2010. As a result, investors have been willing to pay higher valuations for these stronger earnings, and so the double whammy of earnings per share and higher valuation multiples has delivered this world beating performance.

Will it be sustained into the future? This is the question that all investors should be asking themselves, after all, as Warren Buffett once wrote, “if past history was all that is needed to play the game of money, the richest people would be librarians.” Looking ahead at the start of 2025, the US stock market has pretty much everything going for it compared to the rest of the world: stronger earnings supported by a resilient macro backdrop, the highest exposure to AI, a strong dollar, and a President that wants to drive home this advantage. The US is an overweight position in our portfolios for now, for all these reasons. However, there is one caveat. Up to now, valuations have been a tailwind for US investors, having expanded versus other markets. Given the level of relative valuations today, if the US fails to deliver those earnings, that valuation expansion tailwind will become a headwind. In that case, the US will most likely underperform. Investors should be ready and willing to turn away from the bright lights of the US.

One way to think about the likelihood of delivering on those expectations is to consider what is in the price; in other words, can the US continue to deliver the earnings growth required to justify today’s valuations? Bridgewater, the US hedge fund, estimates that for the US to justify its current valuations, earnings need to grow at 9% per year, whereas the rest of the world requires just 2.5% and Emerging Markets (ex-India) need to deliver no earnings growth. This is another way of highlighting how much higher the bar is for further US outperformance from here.

Many observers of markets over the last decade would be forgiven for thinking that US outperformance is the natural way of things. A librarian with a Bloomberg terminal would tell you that’s not the case: Europe (ex UK) outperformed the US in the 45 years between 1969 and 2014. Therefore, US exceptionalism is not a given.

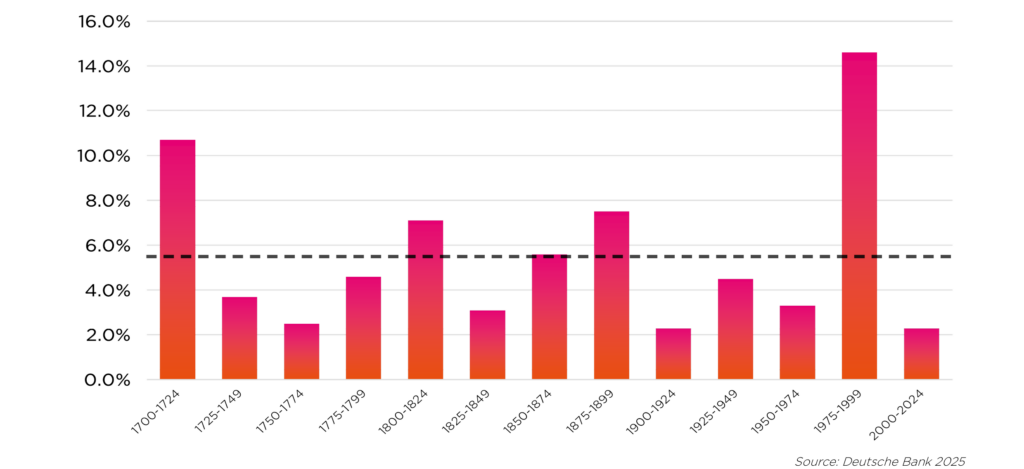

While we’re reflecting on stock market history, Deutsche Bank recently produced a study looking back at UK stock market returns in quarter of a century blocks going back to 1700, as shown in the chart below. Whilst the full history is beyond the time horizon of most investors, 25 years is a reasonable time horizon for many investing for their pension. The study confirms what most investors already know: equities deliver strong returns above inflation. On average, real returns are 5.5% per year (as shown by the dotted black line). This is despite everything that the world has thrown at equity investors since 1700, including world wars, depressions, inflation, deflation and pandemics.

UK Stock Market Real Return

It’s interesting to note that the last quarter of a century has been the joint worst period for investors in the UK stock market, returning a relatively meagre 2.5% above inflation. That’s partly because this period had the misfortune to start on 31st December 1999, when UK equities were at record valuations, and since then earnings have failed to deliver on those lofty expectations. The best 25-year period? 1975-2000, helped by a starting point when prices were at rock bottom levels, and ending at those record high valuations. If you had told UK investors that they were about to enjoy real returns of nearly 15% per annum for the next 25 years after enduring the savage bear market of 1974, they would have laughed at you. It’s worth bearing this in mind when investors dismiss cheap markets out of hand.

Uncovering Opportunities

We believe that there is significant value to be found in forgotten areas of the UK market today. Investment trusts, which have been around since the 19th century, are almost unique in their structure, sometimes enabling investors to buy assets for less than their known underlying value.

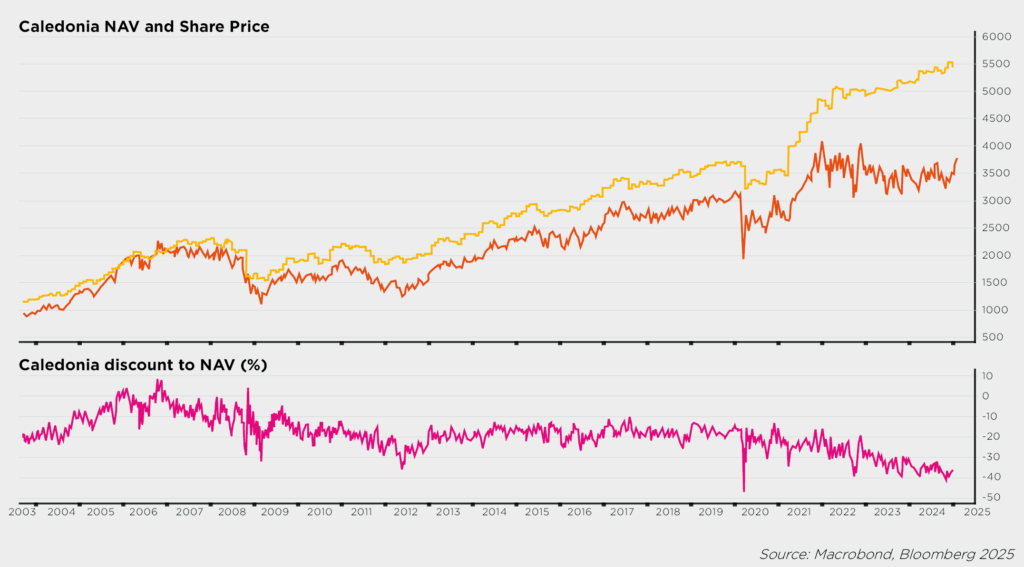

The interesting characteristic of investment trusts is that they have both a net-asset value, like a fund, and a price at which they trade on the stock market. At times of the cycle, these can diverge, presenting opportunities. Of the over 400 listed investment trusts, we have identified opportunities in two trusts that invest utilising an endowment style of investing across equities, private equity and private equity funds. These trusts have high quality assets, which are simple to understand, very strong long term track records, and strong corporate governance. They also trade at a discount to net asset value of 25-35%. In the chart below, we show the NAV performance (yellow), the share price (orange) and discount to NAV (pink), for one of the trusts we recently purchased, Caledonia.

If these trusts return from their current discounts (of between 25-35%) to their long-term average discount of 15%, this will provide a strong capital return before we take into account the possibility of NAV movements. We further think there are catalysts for this to happen: the trusts we own are increasing share buybacks, raising awareness through marketing and acknowledging heightened activism in the sector, aimed at closing discounts.

CONCLUSION

2024 was an exceptional year, with the US dominating the news flow and market returns. We believe that long-term history teaches us to question whether US outperformance can continue forever, especially over longer time frames. In 2025, we expect a broadening of opportunities across different geographies and sectors. Investment trusts are an example of a neglected area of the market that present opportunities for investors who are able to take advantage of the deep discounts that are on offer.